This analysis is most useful if your decision lends itself to quantification in dollars and cents. I did a cost benefit analysis during my first year in the engineering program to compare a career as an electrician to that of an Electrical Engineer. The time to payoff was longer than I had expected, about 12 years overall, but obviously 4 of those years I was earning reduced wages, and also paying for school.

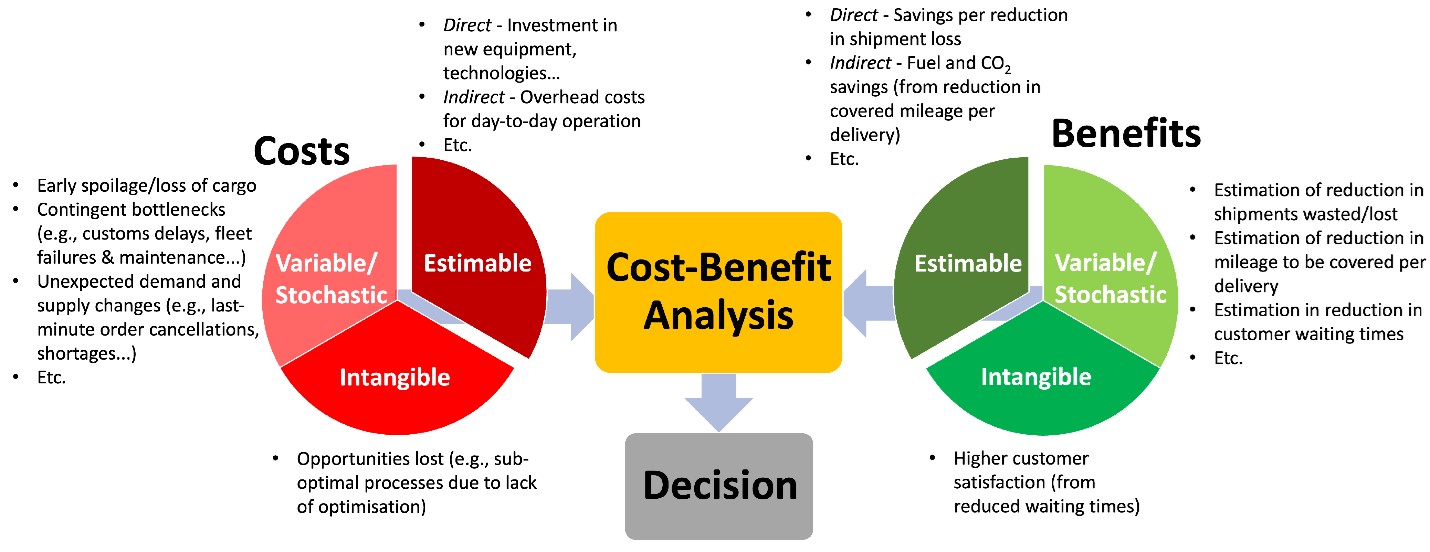

I want to help you understand the diagram above, so let me give some definitions. If the chart already makes sense to you, skip the definitions.

Variable/stochastic: Definition of “stochastic”: randomly determined; having a random probability distribution or pattern that may be analyzed statistically but may not be predicted precisely.

Estimable: Capable of being estimated.

Intangible: Something that can’t be nailed down.

Why would I do a Cost-Benefit Analysis?

What does the process look like? Where do I start?:

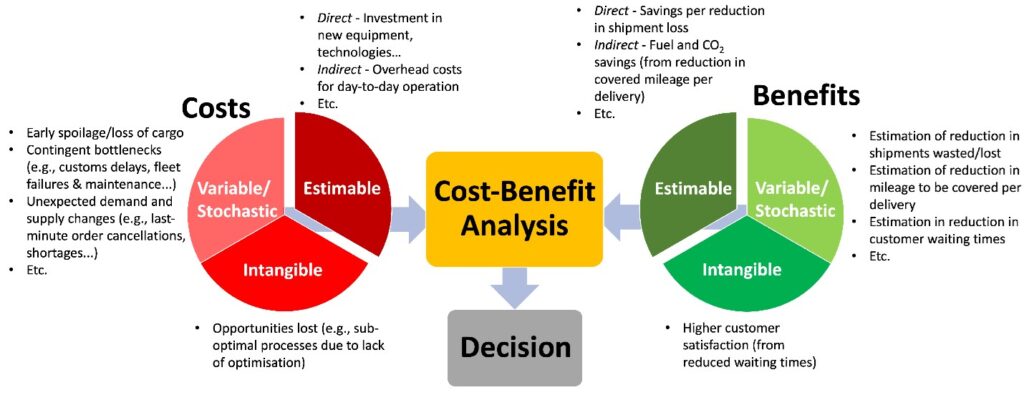

Cost-Benefit ratio: cost divided by benefit. The closer the ratio is to zero, the more likely you should implement that course of action.

Be careful when you are doing analysis of this type. You need to take into account the time value of money. The value of $1 now is not the same as the value of $1 when you are 60 years old. Both because you could invest that $1 in the interim between now and when you are 55, and because earning $1 will likely be significantly easier when you are 55 then it is now.

I’ve been analyzing how I spend my time for the last few days.

As I write these words, I’ve undertaken a project that is very large: I’m building my own house from scratch with no assistance from a construction crew, just me, with a few friends and my wife lending a helping hand from time to time.

If I wind back the clock 5 years, I was spending an immense amount of time on schoolwork in a degree program that I had interest in, electrical engineering.

Wind back the clock 5 years from that, and I was spending an immense amount of time on schoolwork that I had no interest in.

My point is, as I’ve gone from financially insecure to financially secure, I’ve also gradually moved from work and school relating to subjects that were of minimal interest to me, to ones that were exciting to me and that I’ve always had a basic curiosity about.

From that viewpoint I’ve basically moved myself from doing things that were fun and or satisfying, but I had no intrinsic interest in, to things that were fun, satisfying, and I was also interested in. It was merely happenstance that the career path that that I chose also happens to be incredibly challenging, it also rewards those who choose it with higher than average career earnings.

But honestly, we live in the United States of America, and there is so much cash floating around out there that basically any career path can experience a similar trajectory. Which brings me to the point of this post. Any pursuit that we choose as humans must satisfy an innate curiosity that we have (and some people are obviously more curious then others) and when it doesn’t, we will inevitably be dissatisfied with the way that we spend the vast majority of our time. The average person will probably struggle to locate more than 60-70 hours of “free time” per week. If 40 of that is spent at work, what are the chances that you can really satisfy that desire to pursue hobbies and interests in the remaining 25 hours? Perhaps you can, but I think your chances would be significantly better if your career would also provide at least some satiation to your interests.

Here is where people get lost; your career cannot be 100% pursuing your hobby. Every person I’ve ever discussed work/career/life with has always expressed a few things that they wish their job didn’t require them to do. I’ve even had the conversation with people who made their art into a career, (think pottery studio owner) and these people complain about the administrative tasks that are draining for them. You must analyze what your deepest curiosities are about, and then pursue a career that begins to help you satisfy those curiosities.

It is human nature to be dissatisfied with the career that you’ve chosen, but if it is assisting you in your pursuit of a hobby, it becomes a much easier choice to stay with a company or a career path.

Granted, I do have a certain advantage over many people because both myself and my wife know how to live within our means, and that has set me up to pursue school as an adult without crushing student loan debt. But this path is open to far more people then might initially consider it, since the beauty of student loans is that if you carefully choose a higher paying career that aligns with your interests you can use your earnings AFTER the degree program to pay for current expenses.

The moral of the post is that when you have the financial security to do so, making the move to a job that satisfies an innate curiosity of yours can be a very satisfying and engaging life choice, and will definitely increase your satisfaction with your career path.

If you are this far through my blog post, I already know something about you… you care more than the average person about what you end up doing with the majority of your time. Make your job have elements of your hobbies, and you will not dread the morning commute to work.

I hope this post gives you some food for thought. Here are a few steps to get you heading in the right direction:

1. Graduation Rates:

The overall 6-year graduation rate for first-time, full-time undergraduate students who began seeking a bachelor’s degree at 4-year degree-granting institutions in fall 2012 was 62 percent. That means that roughly 1/3 of people who start an undergraduate program don’t finish it.

2. Skilled Trades:

You don’t like school, or you like working with your hands. This was the reason that I initially went into the trades for work. I didn’t believe that school was “for me”. I wanted to work with my hands, and I knew I could succeed at it.

3. You Will Be Successful Regardless

Perhaps you are incredibly gifted. There is a famous study that indicates students who were accepted into elite schools, but went to less selective institutions, earned salaries just as high as Ivy League grads. In other words, successful people are going to be successful regardless of what advantages they are given.

4. Low ROI on college for your career path

High loans/low wages. Many students who graduate have debt that exceeds their annual starting income by 2x or more. This seems problematic. I graduated with less than 1/3 my annual income in student loan debt, and I didn’t pay it off only because I wanted to use that debt to build my first house.

5. You Have Connections:

I’ve run into several people over time who got a good job that they shouldn’t have been able to get because they (or even their parents) were friends with the hiring manager or business owner. Most of the people that I’ve met like this were still working on a college degree, but they were doing it part time because they were also gaining valuable experience. If you have connections, use them!

6. You Don’t Know What You Want To Do:

If you don’t know what you want to do, no reason to waste time and money on a degree. College is expensive and shouldn’t be undertaken on a whim. Do research. Assure that you will succeed in school.

7. You Lack Self Discipline

If you aren’t certain that you will be able to succeed at college level academics, I’d HIGHLY recommend that you search for a career path that would allow you to avoid it. First of all, if you flunk out of or cannot finish for personal reasons, you’ve wasted an incredible amount of time and potentially a lot of money as well. Just wait, your life situation may change in such a manner as to set you up for better success later. But perhaps right now isn’t the time.

I want to stress that you won’t succeed in college without a significant amount of self discipline before you begin, but if you have an interest in something but lack the self discipline to successfully self study that topic to mastery, college may be the route to go. There are people out in the world who can master any topic they put their mind to. My brother happens to be one of them. He completed his bachelor’s degree using primarily CLEP testing. He did it on an accelerated schedule by taking a lot of credits, and while doing so he worked a full time job and had two small children, and carried a 4.0GPA. That is serious discipline. If that isn’t you, then consider college as an alternative. Speaking from my own experience, college vastly improved my self-discipline. During my high-school education I wasn’t forced to keep track of my calendar because of the home-school setting that I grew up in. It was only after several years of college that I developed the ability to work ahead on assignments. College was very good for me in that respect.

2. You are Greedy

You want a decent paying job (especially if you don’t want to work in the skilled trades). If you want a job that clears 6 figures, you’ve got to show your future employer that you’ve got self discipline. The easiest way to do that is by finishing school.

College is not a magic pill that you take once and it solves your career problems forever. College is a key that opens the door to potential career fields you otherwise wouldn’t have had access to. It doesn’t guarantee a job, and it certainly doesn’t a successful and interesting career. But decent grades coupled with some club involvement and/or summer internships virtually guarantee successful employment upon graduation or shortly thereafter.

3. You are interested in a career path that requires a degree.

The chances of you being able to break into a career path without the required schooling are low, very very low. I don’t know how to emphasize this, but especially when you start looking at some of the higher paid positions, you won’t likely be able to work your way into those positions without the required schooling.

4. You don’t like menial labor.

The vast majority of jobs that you can get without an undergraduate degree tend to include a fair amount of drudgery. These jobs usually get more appealing once you have some experience and your wage becomes too expensive to pay for low skill, simplistic, or mindless tasks, but it may take you as long as several years to get to that point. I have friends who have worked very unpleasant jobs for many years, simply to get to the point where their job was almost as pleasant as mine was from day one.

5. You want to broaden your worldview.

It is hard to quantify what it means to be in relationship with people from other cultural backgrounds. If you haven’t gotten the chance to do this during your adolescence, it can definitely be a formative experience that you will carry with you for the rest of your life.

Alright, the last blog post got too long, so I decided to create another one so that I could add some more thoughts and to make it a manageable read.

Banks make your money safer: The banks carry deposit insurance from the FDIC. All sorts of things can happen to money you store at your house: You could lose it, your house could burn down, someone could steal it, etc etc. If it is in an insured bank, you aren’t exposing yourself to those risks.

Banks pay you interest: Additionally, a bit of interest will be added to your account (rates very widely bank to bank, so shop around). I use an online bank bank in conjunction with a local Credit Union.

Banks also make your money a bit harder to get: Some people will argue that this makes no difference, but I’ve often had to pass up purchases that I later would of regretted simply due to not wanting to make a run to the bank. It might not work for you, but I know it has worked for me.

As a side note, bank accounts also are generally required to open an investment account, which is very important for your long term financial help.

Credit cards. I am all for them. In fact, this year alone I’ve gotten $1100 in cash back & rewards from my credit cards. When you hit adulthood and you open a credit card, you need to make a rule for yourself that if you are ever forced to carry a balance from month to month, you will rip up that credit card and never reopen it. The benefits of having a credit card are nullified if it allows you to spend more than you otherwise would.

Make it your rule to never buy something that you know is bad for you: Tobacco Products/drugs/alcohol obviously, but less obviously: soft drinks/candy/icecream.

Ask yourself…. Is it good for me? If the answer is yes, then it is a permissible expense. If the answer is no, then don’t buy it.

Financial wellness is a way of life. Just like physical wellness or mental health. These things don’t happen overnight, and they aren’t necessarily easy. But don’t be discouraged with temporary setbacks. Just keep taking steps in the right direction.

Subscriptions are the devil. There is a reason that all the major software and media businesses are moving to a subscription model. Let me give you a hint, it isn’t so that they can charge you less money over time. Nothing kills your budget faster than guaranteed monthly expenses. The average American spends over $200 monthly on subscriptions. Your goal for subscriptions should be that you spend zero dollars on them. See my post on subscriptions.

If you are spending more than $35 on a phone plan, you are being robbed. I spend less than $20 a month for 10gb of non-deprioritized data on the AT&T network with unlimited talk & text (Red Pocket for those of you wondering what plan I’m on)

I found that cars around the 130,000 mile mark, if they’ve been well maintained, will drive on into the mid-term future without issue. Usually these cars are around 15 years old, and while you might not look flashy, in a 15 year old Toyota or Honda, they are good cars with decent fuel economy, and you won’t regret buying them.

Don’t buy new, and don’t get a loan unless you must.

Renting provides you with a zero maintenance arrangement with guaranteed expenditures (no surprises to wipe out your emergency funds) whereas a house provides you with a potential way to build your wealth, and usually (though not always) a better quality of life.

The single best way to save money is to live with someone else. If it is your parents and free, that is even better.

Only carry it if you can’t stand the idea of not having it. Think: would it be catastrophic for my well-being or financial well-being if I didn’t have this and needed it?

i.e. If you have 4000 dollars in the bank, and a 6000 dollar car, then you should consider carrying comprehensive & collision coverage.

Life insurance only becomes crucial when you get to the having kids stage (then ONLY USE TERM INSURANCE not whole life) if that isn’t you, then don’t worry about it right now.

Rental insurance is often required by your landlord, and isn’t a bad idea if you are living in a high crime area, otherwise it’s probably not necessary.

Homeowner’s insurance: would it be catastrophic for your financial well-being if your house burned down? Yes. So buy insurance.

Pet insurance: This is would be a case by case scenario.

Health insurance: probably not crucial when you are single, young, and poor, but don’t go without for too long, since health issues can crop up (especially sports injuries or higher risk activities like skiing etc).

Is investing in individual stocks a good idea?

Let me change the question: can you make money on gambling?

Yes. But just because you can make money doing something doesn’t mean it is a good idea. The reward is always commensurate with risk. Big financial payoff = big financial risk.

Are you in a situation where you want to risk money that almost certainly you could get 9% annual returns on for the rest of your life in order to gamble? Maybe. Maybe. But don’t come crying to me if you don’t ever get your yacht.

Stock picking is horribly risky compared to dumping your money into a Vanguard investment fund like VTSAX and waiting for the returns to stack up. You are exposing yourself to massive downside risk, without diversification. (60+ stocks in various industries is where diversification benefits start to taper off).

There is no way to tell the future. Anyone who says differently is selling something. Every stock picking strategy that has ever been devised succeeded either based on luck, or failed in the long term compared to the buy and hold strategy.

I will state for the record that picking stocks can be fun. And it can be something that you talk about with your friends. If you must do it. Do it with a small percentage of your stocks.

This is the obvious but often overlooked way to increase your socioeconomic status. If you want to rise above your current status, you have to do it by increasing your earning potential. there are lots of ways to increase your earning potential: School, certificates, a willingness to stay late at work or a willingness to be the one to learn new things. Pick a strategy and knock it out, then pick the next one and knock it out.

I feel like I probably haven’t covered each of these in enough detail. In fact, I think each one of the headings above might deserve it’s own blog post. I’ll be back to cover them in the coming days, months, and years.

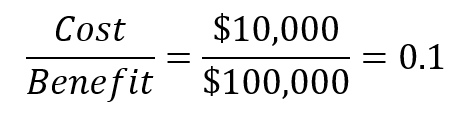

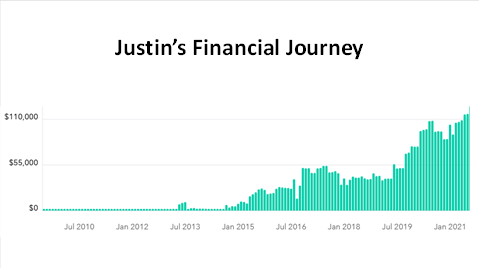

This chart is a fairly accurate view of my net worth over time, give or take a few thousand dollars. This is taken from my mint.com account(a personal finance tracking website). You may guess from the fact that I have data from the time I was ~19 years old on mint.com that I was a bit of a financial freak even at that age. You can see that my wife and I steadily saved money even during our college years(2009-2020). This is in spite of only making $26,555 collectively per year on average from 2012 to 2020. For perspective, the average wage in the United States for a single fast food worker is $25,848. This is about $13 an hour for a full time employee. Somehow we managed to save approximately 40% of our Gross income during that time.

How did we do it?

Alright, so prepare yourself for a new time consuming hobby. If you haven’t already guessed, it is cooking. I have been married to my wife for long enough at this point to realize that she loves cooking. I’m really fortunate that this is the case. But when I lived by myself, I never ate a single meal that I didn’t cook myself. Why? Well to be honest I wasn’t primarily thinking of the health benefits, though I did cook incredibly healthy meals. The real reason was that I didn’t feel I could afford to spend money on eating out. Why would I pay someone to wash my dishes, when I was getting paid ~minimum wage myself? I might as well do the extra hour or so of work each day to prepare all my meals (the meals themselves were not elaborate).

Which brings up another point. I’m not a picky eater. I don’t know what exactly sets our flavor palette, but I’ve noticed that I tend to be satisfied with my meal almost no matter what. It has to be pretty terrible for me not to enjoy it. Give me a bowl of rice and a bit of protein and I’m happy. This served me very well when I was cooking for myself, because I never truly developed a love of cooking, in part because I didn’t have quality cooking tools like pots, knives, or good stove. I was willing to compromise on taste because it wasn’t important to me, but if that is something that is important to you, I’m sure that you will be able to find a core set of recipes that will satisfy you and won’t let you down.

It is hard for me to separate what is actually my preferences, vs preferences I developed because I’ve been a relatively low wage earner for so long. I just don’t love giving gifts. If that is your jam, and you love giving gifts, find ways to make your gifts more about the heart and the intent, and less about the dollar value of the gift that you give. You don’t need to buy your girlfriend a new laptop or camera in order to show them that you love them. They would probably be content with flowers and chocolates (my wife likes just flowers). Also, not to be a scrooge, but the American consumerist mindset around certain holidays and celebrations just doesn’t sit right with me. I recognize I might be on the fringes of society here, but people need to keep in mind that we live in such a wealthy place that extravagant gift giving has been normalized. I’ve seen people spend easily hundreds of dollars on their children. Right now I am getting my kids socks for Christmas, and helping their grandparents purchase a Tricycle for them. That is pretty much it for their Christmas gifts. It isn’t that I don’t love my children, it is just that I choose to let them know that in different ways that don’t require my house to be filled with crappy plastic toys that break after 6 days of usage.

So I admit, this one has always been a little more difficult for me to stick to. When someone invites you out to join them on some adventure that they like to take, it is hard to say no. But don’t ever compromise your goals just so you can spend more time with someone, no matter how cool they are. Some people’s hobbies are really expensive. My local ski mountain is $100+ for a single day lift ticket, and that wouldn’t even include a ski rental. I also have friends that spend thousands of dollars on their hobbies, and make a $120 ski pass look cheap.

Here is probably the most awkward of all the things that I’m going to tell you I do. I legitimately have said no to social invites if they include going to a restaurant. I know, I know, I’m a anti-social grouch, but hear me out. There is a group of people where I work that go out every Friday to get a meal together, during the course of which I’d estimate they spend about $25 each time, that is $1200+ a year in food that I’m not spending. Now perhaps I do eat $2 worth of food each Friday instead of going to the restaurant, but that still means I’m saving around $1100 a year on food. If I invest just this year’s savings, it will be worth around over $10,000 by the time I retire. I’d rather have the $10,000 than the extra time with my coworkers. Obviously this equation doesn’t work in every situation, and if I thought I needed to spend that money in order to advance my career for instance, I would totally do it.

The point is that you can’t let peer pressure force you to spend money that you otherwise wouldn’t spend.

Cheap hobbies are things like hiking, camping, natural resource collection (I’m thinking of picking fruit, hunting, gardening, etc). To be clear though, your hobbies could be vastly different then mine are, the only requirement is that you aren’t spending more than about $5-10 a week on this hobby. (I’m estimating I spent something like that on gas money to do my hobbies.)

It isn’t only what your hobby is, sometimes it is how you do your hobby. Some people manage to spend thousands of dollars on something I can do for $100-200. Do they get 10x enjoyment out of it? Rhetorical question, the answer is no. They don’t. Also, if you find that you can’t participate in a hobby cheaply, maybe you should consider dropping the hobby.

Don’t get me wrong. I think big expenditures to experience something that you will look back on for the rest of your life can be a great idea. A once in a lifetime expense may be worth it, especially if you can amortize the cost over your entire life. For example, a 3,000 dollar trip to Europe might be worth it, if you consider that it is only $1 a week when spread out over your entire life. Keep in mind that just because you have the money doesn’t mean you should use it for this. If $5-10 a week is your goal for your hobbies, just bear in mind that these large trips are coming out of the same financial bucket as your weekly hobbies are.

Low cost or no cost hobbies are great, but they can’t compare to hobbies that make you money. Some of my hobbies are: buying and reselling anything, but particularly tools, trailers, and construction equipment. I’ve averaged somewhere near $2300 per year for the last 10 years. I’ve also kept up a hobby of doing construction work, particularly remodeling houses…I can’t take all the credit for this, but an older gentleman who I got to know during my time in Alaska saw potential in me, and asked me to renovate a house for him. We split the profit when it sold, and I made just a little more money on that transaction than I did on my full time job that year.

If you are a full time student, you should be able to fit in some type of part time work in order to “start thy purse to fattening” This will do two things for you: first, it will provide you with additional funds. Second, it will increase your ability to be efficient with your time. If you don’t have time to waste, you will be less likely to waste your time. The goal is to fall into bed tired at the end of every day, not spend 1-2 hours every night catching up on the latest Netflix. If you aren’t doing school full time in the summers you are going to want to pick up a job. I decided to pursue construction full time in the summers since it was what I already knew how to do. Use whatever skill set you have to make money. If you have no skills you can always be a waiter, busboy, coffee shop barista, valet, janitor or window washer. Don’t let your lack of a resume stop you from being able to find ways to make money.

Alright, this one is polarizing. I feel like about half the population hears me talk about this one and is like “I’ve always wanted to do that” and the other half of the population is like “you did WHAT?”.

Occasionally I run into someone else who has done this, and it always warms my heart to know I’m not the only one who hates to see “valuable” things go to waste. I put valuable in parenthesis because I’ve definitely brought home some things I shouldn’t have from time to time. Here is the thing about dumpster diving. If you are below a certain income threshold, say about $40,000 a year, I think it makes a lot of sense IF (a big if) you can find a dumpster that consistently tosses things that you can use or resell. For me, the only places that I’ve consistently found success was at Home Depot and Harbor Freight. Keep in mind that most of the time you will strike out when dumpster diving, but occasionally you will find something like this:

I managed to sell this chipper/shredder for $550. I spent about $40 and 30 minutes replacing the starter pull cord mechanism.

Be careful not to get injured while in the process of recovery (that chipper shredder weighed like 350lbs and I took it over the edge of a 9ft tall dumpster by myself…..that is a whole story in itself) there are other things to watch out for, like broken glass, sharp pieces of metal and used needles.

One more (often overlooked) spot to hunt is your local dump. I’ve lived in rural areas for most of my adult life, and when you go to the dump often there is no one around who cares if you dig something out of the dumpster.

Obviously this money saving (or money making) strategy is outside the realm of socially accepted norms in some circles, but as long as you are safe about it and respect what people of authority say (store owners or dump employees) you’ll be fine.

During the first 3-4 years of our marriage we spent almost as much time living with people as living on our own. The first 9 months of my marriage I spent living in a rented room with my brother and his wife.

Next we spent 21 months in a section 8 apartment in Chicago, then we spent the next 10 months or so with a friend of my wife’s in a 2 bedroom apartment in Alaska. We haven’t lived with anyone else (except our kids) since then, but I would totally consider it if the opportunity arose.

This might be self explanatory, but replacing the stores you currently shop at with garage sales and thrift stores will radically change the amounts of money you spend. I’ll confess that I’ve never been a fashionista, but I have a certain aesthetic that I find I can satisfy with regular stops at thrift stores and garage sales. Shopping isn’t my favorite activity in the world, but if I do shop, it is at thrift stores (for clothing) or garage sales (for other random things).

If you want to become a financially responsible you must realize the difference between a need and a want. A need is something that you can’t do without. Food, shelter, and clothing are the ones that immediately jump to mind, but there are others. For example, if you live in the country where there is no public transportation, some form of transportation such as a car may become a need. Then you will need to carry insurance on it, pay for gas to operate it, as well as maintenance costs as they arise.

Don’t fall prey to the mistake of buying things you wouldn’t normally buy just because they are cheap. You didn’t save money there, you spent extra money.

There are three costs to every purchase: the cost to buy it, the cost to keep it, and the cost to maintain it. Having a cluttered house or garage is such a colossal waste of time. Sorting through supplies to find the one you need is expensive. Owning covered storage to put it under is expensive. Heating or cooling that area is expensive, etc etc etc.

Related to the “Wants vs Needs” concept is the idea of a cool off period. If you have something that you want to buy, but aren’t sure if it is a want or a need, or you know it is a want but you still are inclined to buy that thing, give yourself a cool off period. I’ve done cool off periods from 1 day to several months. It depends primarily on the size of the purchase. The idea is to let life go on for a while without that thing, and see how you manage. If you can manage for one month, could you manage for a year? If you can manage for a year, I guarantee you can manage for the rest of your life. Which means you should never buy it.

College is expensive. There is no way around that. I’m a huge fan of college as a way to increase your earning potential and job security, but I recognize it can be difficult to line up the free time and finances to go about pursuing a college degree. If you need help in this area, see my College On The Cheap post. Remember, college isn’t for everyone, but if you are trying to rise above your current socioeconomic status, it is one of the easiest ways.

If you don’t have an emergency fund, you are a ticking financial time bomb. Emergencies happen to everyone. Some common examples of emergencies might be:

• Job loss.

• Medical or dental emergency.

• Unexpected home repairs.

• Car troubles.

• Unplanned travel expenses. (death of a loved one etc)

The reason these can be detrimental to your financial health is that raising money to cover one of these expenses can become very expensive in itself. Short term loans, credit card debt, and other common forms of consumer debt tend to be a terrible waste of money. Once you paid off the original amount you needed to borrow, you still have to cover the expenses incurred by the lender in making that loan, aka you need to help them make a profit. If you do this, whatever benefit you received from not maintaining an emergency fund will be far outweighed by these costs. For the record, the following are not emergencies: 1. Expenses that you knew were coming. 2. Anything that involves a hobby of yours.

Roth IRA’s allow you to be exposed to the upside of the stock market without tax implication. In other words, any gains you make on the money you put in a Roth IRA are not taxed. The reason I like Roth IRA’s for low income individuals is that you can use them as a form of bank account. 100% of your original contribution to a Roth IRA retirement account can be withdrawn at any time, for any reason, and without penalty. If you need to pull it out for any reason (for example to help your brother with medical bills) you can do so. I’ve contributed to a Roth IRA every year I when I was working full time and highly recommend you do the same.

As a Christian I personally find 10% to be a compelling minimum number to give back toward what God is doing in the world. If you ascribe to a different set of beliefs, don’t be afraid to support them. What you do with your money says a lot about who you are as a person. Don’t neglect giving unless you find that you cannot meet the basic needs as discussed under the heading “Only Buy what you NEED” above.

Some of you may be disappointed to hear this, but I’ve never found budgeting to be a compelling or important part of my financial journey. Maybe I’m just so cheap that things like budgets don’t help me. Maybe I’m just too lazy to budget. I don’t know, but I always have good idea of how much money is coming in due to monitoring my bank accounts, and I always know where my money is going from my credit card statements. I find that is enough to set me on the right financial path. If you disagree with me, that’s fine. Go find another blog to read… haha.

My single most important piece of advice: do whatever you can to increase your self discipline. This is the one life skill that will take you further than any other in life. Don’t let money control you… control your money.

This post is getting long, so I’m going to stop it here and make another post with the same title.

The average American Family spends $237 a month on subscriptions. Here are my strategies for avoiding these income sucking recurring expenses:

Youtube works great for this if you want specific songs. If you are looking for a good playlist mix, then Pandora is worth a try. Many of the bands that I listen to were discovered through songs from Pandora. See my adblock section to avoid listening to sponsorship ads on both Youtube and Pandora.

I find that this isn’t a terribly important thing for me. It isn’t that I don’t like to vibe, but I tend to spend a lot of time driving in the car by myself at this period of my life, and I have always found that time conducive to audiobooks. If I do want to listen to music, I have an app called NewPipe, and this allows me to listen to youtube videos ad free. It is a great app, and has totally replaced the youtube app on my phone.

I use the uBlock Origin extension for Firefox on my laptop. This blocks commercials on Youtube and Pandora. On my phone I use the extension “NewPipe” when I play youtube videos. This eliminates sponsorship ads. I don’t listen to Pandora on my computer.

I use Ebay and Aliexpress extensively. That being said, Amazon is the one subscription that I pay for. I have a student account, which is half price. In 2023, I spent about $6000 on Amazon.com. Which means that my Amazon Prime Visa credit card (which nets me 5% back per purchase instead of the 2% that I get with my regular cash back card) netted me around $300, which is $180 MORE than a 2% cash back card would have. Thus paying for my subscription, and making me a tidy profit. Additionally, and I can’t say this for certain, but I suspect that the customer service representatives are more accommodating when they see that I’ve had a subscription for 9 years or whatever. On any given year I save ~3x what I pay in subscription costs. Most of this is through product support. For example, recently (last week at the time of my writing this) I received a refund on a $200 item that had a few pieces missing. I was able to order the missing pieces for about $30 online, meaning that that single transaction paid for the next 3 years of my Amazon membership. I also provide one of my siblings and my parents access to Amazon, since they are also cost conscious value added shoppers like me.

First of all I discovered a few years back that no one really cares if you’ve watched such and such a movie or series. People often like to relate to others through film, and they will bring up plot lines or movie quotes, and if you don’t tell them differently, they’ll assume you have some idea what they are talking about. I personally enjoy reading synopses of shows or movies on Wikipedia, and occasionally I’ll watch a few movie trailers on youtube. This gives me the basic familiarity with the plot lines, characters, and funny moments without the massive time investment required to watch the whole movie or tv series. People, for whatever strange reason, like to be able to connect over something that they have both experienced. I like to be able to relate to people, and I don’t follow sports (another common connection point), so I try to spend an hour or two every few months doing this instead.

When I was in college and had access to a gym, I used it 2-3 times a week. I found it to be helpful to have someplace where I could go, not think about anything, and just do some physical activity. Regular exercise at home is difficult as I have young children who like to be with dad and copy whatever he is doing, and it just makes blocking out time and space to work out challenging. Right now I am building a house, and I find that the amount of exercise that I get from moving raw materials around and crawling on and off my tractor provides sufficient exercise for me. I honestly think that I may be more fit now then when I was hitting the gym multiple times a week while in college simply because my weekends are very physically demanding. As time goes on and I finish the house build (and gain a bit of free time) I’m open to the idea of a gym membership, since if it takes me from zero exercise to multiple days of exercise weekly, the price of the gym membership would be insignificant in comparison to health care expenses down the road.

For years I was on a family plan with my brother on AT&T. I felt like my connectivity was good with them, but they were $30 a month per phone. Not as expensive as some people’s plans, but I eventually found something better. I now spend 12-15$ a month on my phone plan with RedPocket. I have the same network (AT&T) and I’ve never really noticed any significant connectivity issues.

Do people really still spend money on this? I use my local library’s subscription if I ever need to log on to the New York Times or a similar website to finish an article, but mostly I’ve come to the realization that it isn’t important to keep up on the news. Anything that is truly important tends to get communicated to me via my friend group, and that is, in my opinion, a much better way to learn about news then any journalist, no matter their style. This is because news doesn’t matter. 99% of the news article I’ve ever read didn’t truly matter to me. If this is your hobby, that is fine, but it certainly isn’t mine. I can’t find it in me to care.

I think it is important to carefully structure your life to allow time for the cooking and consumption of food. I’ll be up front and say my wife does significantly more of the food prep than me. I tend to be on tap for waffles, pancakes, and scrambled eggs, etc. She seems to enjoy it, and I’ve never felt the need to step in and take it from her, though if she ever goes back for her Master’s there is a good chance I’ll need to step it up.

People often talk about hobbies as something that they couldn’t imagine themselves without. Video games used to be that for me. I loved them. I still do, there are about 3 or 4 strategy games that I’ve played over time that I would love to spend an afternoon (or seven) enjoying. But I have instead chosen as my hobbies things that are more physically demanding. Hiking, construction, etc. Choosing not to game was a default because I wanted to do things with my time that prevented me from gaming (construction/hiking/electrical engineering). If I had continued gaming instead of taking up those hobbies, my career prospects, financial situation, and probably my mental health would have all suffered.

So I do pay for this website, it is about $75-100 annually. That is only because I want a public platform where I can share who I am (and my thoughts) without pointing someone to a social network website. I don’t pay for anything else software or cloud related. I’ve used Libreoffice for years (though my work and my school both currently have a Office 365 subscription for me).

I do pay fees on several of my accounts, but they aren’t management fees, just fund fees of around 0.08%. My bank(s) charge me nothing. I do have a loan for the property that my wife and I recently purchased to build our house on, so I spend money on the interest on that money, but the amount I spend on interest is less than the appreciation on my property right now, so I’m not too distraught about it.

I use my library extensively for this purpose. Overdrive, Hulu, and the free website Librivox. It is rare that I can’t find a specific book, If I do, I just add it to a list, and check a few years later to see if it’s distribution has broadened. Very rarely do the books I read need to be finished by a certain date.

I lived in Alaska for the last 6 years. While there I developed a love of hiking, although I’d always loved the outdoors. No matter where you live, making the most of that location is important. I’ve found that I’m most content in an area that allows me to have outdoor hobbies. Following are some strategies that I’ve used for making the most of our time outdoors:

It amazes me sometimes when I find out that people aren’t using this website. They also have a pretty killer paid app for more intense hikes, but I find that the free version is more then sufficient for most hikes that you will do with small children. I personally prefer to look at hikes ahead of time, and if it looks like a challenging hike I will screenshot and print out the topographical map of the area.

I enjoyed many hikes before I started tracking them. But I started to record hikes on Strava in 2019, and let me tell you, adding a social aspect to exercise makes it more enjoyable. This app allows you to connect with friends so that you can congratulate them on their last adventure, and so that you can share how much vertical rise you did, or how many miles you hiked last year. I also enjoy seeing how slow (or fast) we travel as a family (2mph turns out to be top speed for us). The longest hike we’ve done as a family was shy of 14 miles. My kids at the time were about 1, 2, and 3 years of age.

So I’ll be honest and say I’ve never really spent much time using these hiking groups, but my wife has made extensive use of them over the years. These are the places where you go to get ideas for your next hike, to find out trail conditions (and whether there are bears closing down a trail!) or whether the mud or snow on the trail makes the hike unenjoyable.

Depending on your friend group, there may be a wealth of knowledge in the people who you interact with on a daily basis. It always amazes me, even when people are seemingly not outdoorsy people how they may have a favorite camping spot or hiking spot that you might not hear about otherwise. Tell everyone you are looking for a new place to hike and see what they say. You never know what kind of adventure someone might suggest.

Lets face it, being outdoors in crummy weather is a miserable experience IF you are unprepared. I’ve done some incredibly long hikes with young children, and I won’t say they were more joyful then usual, but they are pretty resilient if they have rain jackets and good snacks.

Seriously, S.N.A.C.K.S. This is the difference between the worst 4 hours of your life, and another day hike with your kids. My wife brings along enough food to give us the calories that we need for a strenuous hike. Sometimes she will pack so much that I’ll groan and complain as I put the pack on, although this has lessened of late since each of the kids has their own backpack.

I like to think that our kids are tougher than most, but we decided they were ready to carry their own water and snacks at age 2 years 9 months. We prefer camelbak’s soft sided water bladders with a straw that comes out of the backpack and can be hooked to their front shoulder strap to allow sips on the go. Keeping hydrated is important, and the kids already go slow enough that we don’t want to wait for them to dig a water bottle out of a backpack to take a drink. The backpack doesn’t have to be anything impressive either. We’ve managed to get along with fairly cheap backpacks, and one of them isn’t even designed with small children in mind, but the straps tighten down tight enough to make it work.

Don’t try to keep the pace that you would normally do if you were hiking on your own. I’ve learned that I need to slow down to enjoy hikes with my family. I find I get more exercise than I think sometimes because I’m carrying kids, as well as extra snacks and water.

Berries on the trail are a huge boon when you are hiking with young children. I’ve always loved foraging, and my kids picked up on that gene in a serious way. The berries don’t have to be terribly sweet either, they are willing to eat even the unripest of berries if they know they are edible. One of the best ways to discover if a berry is edible is to ask people who you see picking what they are picking. People who forage usually love to share what they are doing, and you can gain a wealth of knowledge about berry picking this way.

Especially on longer out and back hikes, it can be a good idea to check in with people about trail conditions, animal activity, or just to say hi. It might seem odd to check in with people you meet on the trail at first, but people are rarely 1-2 hours hike from their car in everyday life, (as well as out of cell phone range) and tend to not mind the occasional hello on the trail. Occasionally you’ll even be able to strike up a fun conversation with someone. One time we bumped into an 88 year old on the trail, and he had great stories. Unfortunately he outpaced us eventually. If someone looks haggard, be sure to ask how they are doing or on a hot day if they need water.

This seems like an illogical question since everyone knows that electrical engineering requires an immense amount of math. If you are concerned that math might be the only thing blocking you from your desired career as an electrical engineer, listen closely to my story, you may be surprised what you can do.

It is difficult give any idea of my 1-12th grade academic/mathematical prowess, but I’ll attempt to do so here. As a bit of background: I started kindergarten right before my 6th birthday, making me an older than average student. In 1st grade my mom realized that I probably should have been in 2nd grade, and at least in math she forced me to do two lessons a day for the entire year. This reflects an early ability to work with numbers, but is by no means indicative of my ability overall in mathematics. I definitely remember this year as I was proud of the fact that I was getting ahead in math, but some days were a real drag for a 7 year old. From there I enjoyed a pretty standard grades 2-7, and when I reached 8th grade, my mom put me in Algebra 1.

Algebra 1

I hated Algebra 1. We used Bob Jones University curriculum, but I think it would have been the same for any other curriculum. I simply was not curious, and I didn’t want to learn. Only by the willpower of my mom was I dragged kicking and screaming through that year of school. It was absolute misery.

I remember asking my mom many many times “when will I ever use this?” The point stands, although I must thank her for her perseverance, particularly on Algebra 1, in which I received a final grade of A.

Course content: graphing, solving systems of equations, operations with polynomials and radicals, factoring polynomials, solving rational equations, and graphing quadratic functions.

To this day, I remain subpar at factoring, a result of my early and longstanding resistance to this part of mathematics. I never viewed it as a puzzle, and I think that would have helped keep my frustration levels at a lower level.

Algebra 2

When I started Algebra 2, I thought it was going to be terrible, but since I had come to the conclusion that it didn’t matter whether the concepts connected to real life, I recall this year being a bit easier than Algebra 1, although I think it was still pretty tough, and I have an email from this era that contains me complaining about how difficult Algebra 2 is.

Course content: quadratic equations, polynomials, complex numbers, and trigonometry.

Geometry

After Algebra 2 I completed geometry. Bob Jones University Press’s Geometry text is Euclidean in its approach.

Course content: Set theory, definitions, postulates, and theorems. introduction to trigonometry. From the 5th chapter on formal proofs are used and the number of proofs required is extensive.

I’ll be honest and say that I got lost after we got to “geometric proofs” because I didn’t put the time in that would have been required to master the content. My decision to give up was influenced heavily by the fact that I was aware my older siblings hadn’t completed the proofs section, so I could get away without doing most of it. This was the first time that my mom couldn’t really be of any assistance to me. I think she had a decent understanding of basic algebra, but geometric proofs was beyond her. I did learn to make constructions with straightedge and compass, which was amazingly fun. Without a doubt the first few weeks/months of this course were the most enjoyable part of any math class I’ve ever taken. I think back quite fondly on the first few chapters of that course.

Although I did technically “complete” this textbook, I only did it by spending about 1.5-2 hours a day on this subject, and by only doing small subset of the assigned homework. There were many days when I could only do a single homework problem, even with the 2 hours of study time. As it turns out, teaching yourself math from a marginal textbook, without using the internet is a very difficult proposition. This math still remains some of the most difficult I’ve ever completed. I think I would have given up far earlier, but being unable to complete the geometry textbook was maddening to me, and I also knew that if I completed the Advanced Math textbook, it would be a way of asserting that I was smarter than my siblings, all of whom had started that textbook and then failed to finish. I firmly believe that this is the only reason I attempted to finish this semester of math.

Course Content: Trigonometry, functions, graphing, conic sections and polar graphing, equations, matrix algebra, complex numbers and vectors, polynomials and rational functions, sequences series and math inductions, and calculus.

A little more than two years (775 days) after my final high-school math lesson, I took a Technical College math placement exam. I remember studying for this a bit, but I know I was working full time when I took it, and I’d estimate my hours studied to less than 10 hours. I scored a 92/100 on High-school Algebra, and a 22/100 on College Algebra. This qualified me to enter the following Classes:

Obviously I wasn’t a mathematical genius, but I did have a passing knowledge of high-school level algebra.

From that point on, I did no study in mathematics for 2 years, 5 months (885 days). At that point I took a CLEP examination for College Mathematics. I remember studying for this a fair amount, but I also took it in the middle of a semester when I was working 25 hours a week and going to school full time, so I couldn’t have put to many hours into study. I’d guess about 15-20 hours of study, likely even less. I needed a score of at least 50 at my college so that I didn’t have to do any math or quantitative reasoning classes. I got a 64, which to my mind meant that I studied too much. The CLEP test covered the following subjects:

Algebra and Functions (20%) Counting and Probability (10%) Data Analysis and Statistics (15%) Financial Mathematics (20%) Geometry (10%) Logic and Sets (15%) Numbers (10%)

At this point you can see that the self study that I had done had drastically improved my college level mathematics skills, but I think the improvement also more likely reflects that the CLEP exam is easier than the College Portion of the Compass exam that I had taken two years earlier.

2 years 8 months (978 days) after my CLEP test, I took another college placement exam. This time in a bid to qualify for placement in Calculus 1. I took this test twice. I would estimate 5 hours of study prior to the first attempt, and 20+ hours prior to the second attempt. The minimum required score for placement into Calc 1 was an 80. The first time I scored 57, and the second time I scored 74. The advisor that I talked to after I got the 57 told me that even with that score it was fairly likely I could convince a prof to let me into their Calculus class, so I didn’t study quite as hard as I probably should have for the second attempt and only got a 74 on the second try. I had to email a couple different professors in order to find one that would allow me into their Calc 1 class with this score, but I did eventually find one.

The Accuplacer covers:

Whole numbers Integers, Fractions, Decimals, Expressions, equations, & word problems, Inequalities & functions, Linear equations & systems of equations, Exponents & polynomials, Factoring Rational expressions, Radicals, Quadratics, Ratio, proportion, & percent, Geometry, Measurement, Probability & statistics, Coordinate geometry, Negative & rational exponents, Composite functions & inverses, Logarithms & exponential functions, Advanced polynomials

The University of Alaska Anchorage also requires a course in Trigonometry, but I didn’t ever take a highschool class in Trigonometry. I was allowed to sign up for Calculus 1 even though I was at best, unprepared in every area of math, Algebra, Trigonometry, and Precalculus. By rights I should not have passed that course. Our professor allowed open book and open notes on all exam problems, and provided an almost unlimited amount of time to complete the exam. I used this to my full advantage and I’m not certain I would have passed the course had it been the traditional testing style.

The reason that I wrote all this out was to explain that I was by no means ready for Calculus 1 when I started college. And yet, I managed to get through. My lack of mathematical prowess was a significant drag on my grades from that point forward. I would guess that roughly 90% of the grades that I received that weren’t A were because of my relative incompetence at math either directly, by flunking a test, or indirectly by having to spend inordinate amounts of time studying for classes that were math heavy.

Can you go back to school at 26 and succeed in engineering if you were marginal at math in highschool? The answer is yes, but you need to make sure that you are the type of person who finishes what they start. Engineering school was not fun. Was it worth it? Yes, without a doubt. But I can’t say I recommend it unless you really feel like you do not want to enjoy your college experience. Haha. Jokes aside, I wouldn’t change anything. If engineering did anything for me it increased my self discipline significantly, which isn’t something that you can really put a price on.

I also want to emphasize that it would have been significantly easier for me to get better grades had I been willing to go for 2-4 semesters of remedial math. Unfortunately, that did not work with my life plans (I wanted to be done with school before my kids had firm memories), and I also just couldn’t stand the thought of the extra time prior to getting my engineering degree.

I don’t think anyone should let their age dictate whether they go back to school. The human mind is amazingly capable of learning, don’t be afraid to try something that is hard. But know that it will be hard, brace yourself, and hit the ground running. If you are average, or slightly above average intelligence, you can definitely finish an engineering degree.

First of all, you have to be motivated to succeed. I don’t know how to help someone with that, so I’m going to skip it. Instead I’ll talk about what I do know…how to succeed once you are motivated.

Engineering school takes time. Lots of time. I’d estimate the average 3.0GPA and above student spent well over 40 hours a week on school. Some spent as many as 80. Go to school early in the morning, and don’t leave at night until all your homework is done. I don’t know how to say this, but electrical engineering can be dry subject matter. There are no engaging story lines in this field, aside from the ones that you write yourself. Occasionally professors will bring up how a discovery was made in engineering or science, but these are few and far between in an engineering program that on average takes 5 years to complete. You must constantly remind yourself why you are doing this, what it is you want out of the program, and how it will benefit you in the long run.

Use a Calendar. Carry the calendar with you everywhere (I printed mine on 8.5×11 sheets of paper and put it in my assignment binder) as soon as you are assigned a project, put it in the calendar. Live and die by that calendar. If an assignment changes dates, make sure that you change the date in the calendar. Continually come back to that calendar, use it to motivate yourself (or others if you can’t do your homework without them).

If you didn’t crush Calculus 1 in highschool, don’t expect to be able to pick this up without remedial math, and a lot of hard work. Start working on your math skills right now (preferably before the semester starts). My own math background was lackluster, and I managed to get through the program via sheer willpower. It can be done without this prowess, but the engineering program will be much easier for you if you excel at math.

Go and talk to your professors. This is so inconvenient, but there are times when it is very worthwhile. I would sometimes force myself to complete assignments a day or two early only so that I could go and talk to the professor before the item was due when I had a problem. Some professors are vastly more helpful then others are. You’ll discover in the first few weeks of a class which professor is helpful and which is not. I also discovered that many professors like (or at least don’t mind) if you come to them to talk over a test that you recently completed. It helps them see that you care about their class, especially when your grade on the exam was better than average.

Make school friends: The more friends you have, the less likely you are to miss something important that will affect your grade. Especially make friends with at least one person who knows how to take good notes. Sometimes being able to look over the notes that someone else took can save you a lot of points on a homework or exam.

Don’t be afraid to ask for help. This was a hard one for me personally because I always felt like it was cheating to ask for help. Like somehow I should be able to do this all on my own. Obviously there are cases where you can’t do this (take home tests for example) but when not specifically prohibited from doing so, I would often find someone who was doing better in the class then me, and bug them. This got far easier as I got further into the program and had built relationships with people who started the program around the same time as me.

Don’t use Chegg. This might be a controversial take, and I think that there are strong opinions on both sides, but I don’t recommend Chegg. I feel like having this subscription was a barrier to learning for many of my fellow classmates. That being said, I highly recommend having a friend that you do homework who has Chegg. That way if there is one question that you are both stuck on, they can look it up for you and walk through the problem. Depending on how much busywork your school requires, having this subscription may be more or less detrimental to your learning.

The best resource on the internet for engineer students is doubtless this website. Obviously geared toward physics, but helpful none the less.

Somehow they manage to make learning equations fun. The other CrashCourse courses are very good too, but physics is probably the best.

This guy knows how to teach circuits and electronics. A friend of mine found him on Youtube, and he helped me immensely. You’ll spend 1/3 the time learning that you would with other lecturers, because he doesn’t ever allow you to get confused.

His videos come up often using youtube search for STEM search terms. His videos are gold.

MathtutorDVD “Math and Science”

This guy knows what it takes to learn Math (and several other subjects) and can break the process down it to small steps that anyone (even the math challenged) can master. It would probably be worthwhile to order the DVD’s from him, but I never did.

Super strange and memorable dude. Reminds me of a rarely seen eccentric uncle. But sometimes his examples are so spot on that you really can’t beat him.

Useful during calculus based Physics 1 & 2

This website has answers to the “canned” textbook questions that are a waste of time. I must emphasize that you should never look at the answer to a question before you have spent a fair amount of time understanding what the textbook has to say about that subject, and thoroughly completed the problem (attempting to do your best to solve it). There are no shortcuts to learning.

These are best for real world practical application, not theory, but they always reminded me why I chose EE in the first place: