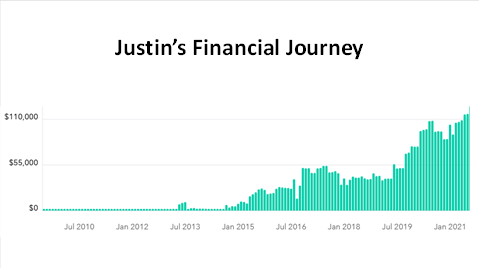

This chart is a fairly accurate view of my net worth over time, give or take a few thousand dollars. This is taken from my mint.com account(a personal finance tracking website). You may guess from the fact that I have data from the time I was ~19 years old on mint.com that I was a bit of a financial freak even at that age. You can see that my wife and I steadily saved money even during our college years(2009-2020). This is in spite of only making $26,555 collectively per year on average from 2012 to 2020. For perspective, the average wage in the United States for a single fast food worker is $25,848. This is about $13 an hour for a full time employee. Somehow we managed to save approximately 40% of our Gross income during that time.

How did we do it?

Eating Out Less

Alright, so prepare yourself for a new time consuming hobby. If you haven’t already guessed, it is cooking. I have been married to my wife for long enough at this point to realize that she loves cooking. I’m really fortunate that this is the case. But when I lived by myself, I never ate a single meal that I didn’t cook myself. Why? Well to be honest I wasn’t primarily thinking of the health benefits, though I did cook incredibly healthy meals. The real reason was that I didn’t feel I could afford to spend money on eating out. Why would I pay someone to wash my dishes, when I was getting paid ~minimum wage myself? I might as well do the extra hour or so of work each day to prepare all my meals (the meals themselves were not elaborate).

Which brings up another point. I’m not a picky eater. I don’t know what exactly sets our flavor palette, but I’ve noticed that I tend to be satisfied with my meal almost no matter what. It has to be pretty terrible for me not to enjoy it. Give me a bowl of rice and a bit of protein and I’m happy. This served me very well when I was cooking for myself, because I never truly developed a love of cooking, in part because I didn’t have quality cooking tools like pots, knives, or good stove. I was willing to compromise on taste because it wasn’t important to me, but if that is something that is important to you, I’m sure that you will be able to find a core set of recipes that will satisfy you and won’t let you down.

Give Less Gifts

It is hard for me to separate what is actually my preferences, vs preferences I developed because I’ve been a relatively low wage earner for so long. I just don’t love giving gifts. If that is your jam, and you love giving gifts, find ways to make your gifts more about the heart and the intent, and less about the dollar value of the gift that you give. You don’t need to buy your girlfriend a new laptop or camera in order to show them that you love them. They would probably be content with flowers and chocolates (my wife likes just flowers). Also, not to be a scrooge, but the American consumerist mindset around certain holidays and celebrations just doesn’t sit right with me. I recognize I might be on the fringes of society here, but people need to keep in mind that we live in such a wealthy place that extravagant gift giving has been normalized. I’ve seen people spend easily hundreds of dollars on their children. Right now I am getting my kids socks for Christmas, and helping their grandparents purchase a Tricycle for them. That is pretty much it for their Christmas gifts. It isn’t that I don’t love my children, it is just that I choose to let them know that in different ways that don’t require my house to be filled with crappy plastic toys that break after 6 days of usage.

Don’t be afraid to say NO to other people’s hobbies

So I admit, this one has always been a little more difficult for me to stick to. When someone invites you out to join them on some adventure that they like to take, it is hard to say no. But don’t ever compromise your goals just so you can spend more time with someone, no matter how cool they are. Some people’s hobbies are really expensive. My local ski mountain is $100+ for a single day lift ticket, and that wouldn’t even include a ski rental. I also have friends that spend thousands of dollars on their hobbies, and make a $120 ski pass look cheap.

Here is probably the most awkward of all the things that I’m going to tell you I do. I legitimately have said no to social invites if they include going to a restaurant. I know, I know, I’m a anti-social grouch, but hear me out. There is a group of people where I work that go out every Friday to get a meal together, during the course of which I’d estimate they spend about $25 each time, that is $1200+ a year in food that I’m not spending. Now perhaps I do eat $2 worth of food each Friday instead of going to the restaurant, but that still means I’m saving around $1100 a year on food. If I invest just this year’s savings, it will be worth around over $10,000 by the time I retire. I’d rather have the $10,000 than the extra time with my coworkers. Obviously this equation doesn’t work in every situation, and if I thought I needed to spend that money in order to advance my career for instance, I would totally do it.

The point is that you can’t let peer pressure force you to spend money that you otherwise wouldn’t spend.

Develop Cheap Hobbies

Cheap hobbies are things like hiking, camping, natural resource collection (I’m thinking of picking fruit, hunting, gardening, etc). To be clear though, your hobbies could be vastly different then mine are, the only requirement is that you aren’t spending more than about $5-10 a week on this hobby. (I’m estimating I spent something like that on gas money to do my hobbies.)

It isn’t only what your hobby is, sometimes it is how you do your hobby. Some people manage to spend thousands of dollars on something I can do for $100-200. Do they get 10x enjoyment out of it? Rhetorical question, the answer is no. They don’t. Also, if you find that you can’t participate in a hobby cheaply, maybe you should consider dropping the hobby.

Frequency of Epic Adventures

Don’t get me wrong. I think big expenditures to experience something that you will look back on for the rest of your life can be a great idea. A once in a lifetime expense may be worth it, especially if you can amortize the cost over your entire life. For example, a 3,000 dollar trip to Europe might be worth it, if you consider that it is only $1 a week when spread out over your entire life. Keep in mind that just because you have the money doesn’t mean you should use it for this. If $5-10 a week is your goal for your hobbies, just bear in mind that these large trips are coming out of the same financial bucket as your weekly hobbies are.

Develop Negative Cost Hobbies

Low cost or no cost hobbies are great, but they can’t compare to hobbies that make you money. Some of my hobbies are: buying and reselling anything, but particularly tools, trailers, and construction equipment. I’ve averaged somewhere near $2300 per year for the last 10 years. I’ve also kept up a hobby of doing construction work, particularly remodeling houses…I can’t take all the credit for this, but an older gentleman who I got to know during my time in Alaska saw potential in me, and asked me to renovate a house for him. We split the profit when it sold, and I made just a little more money on that transaction than I did on my full time job that year.

Part time work

If you are a full time student, you should be able to fit in some type of part time work in order to “start thy purse to fattening” This will do two things for you: first, it will provide you with additional funds. Second, it will increase your ability to be efficient with your time. If you don’t have time to waste, you will be less likely to waste your time. The goal is to fall into bed tired at the end of every day, not spend 1-2 hours every night catching up on the latest Netflix. If you aren’t doing school full time in the summers you are going to want to pick up a job. I decided to pursue construction full time in the summers since it was what I already knew how to do. Use whatever skill set you have to make money. If you have no skills you can always be a waiter, busboy, coffee shop barista, valet, janitor or window washer. Don’t let your lack of a resume stop you from being able to find ways to make money.

Dumpster Diving

Alright, this one is polarizing. I feel like about half the population hears me talk about this one and is like “I’ve always wanted to do that” and the other half of the population is like “you did WHAT?”.

Occasionally I run into someone else who has done this, and it always warms my heart to know I’m not the only one who hates to see “valuable” things go to waste. I put valuable in parenthesis because I’ve definitely brought home some things I shouldn’t have from time to time. Here is the thing about dumpster diving. If you are below a certain income threshold, say about $40,000 a year, I think it makes a lot of sense IF (a big if) you can find a dumpster that consistently tosses things that you can use or resell. For me, the only places that I’ve consistently found success was at Home Depot and Harbor Freight. Keep in mind that most of the time you will strike out when dumpster diving, but occasionally you will find something like this:

I managed to sell this chipper/shredder for $550. I spent about $40 and 30 minutes replacing the starter pull cord mechanism.

Be careful not to get injured while in the process of recovery (that chipper shredder weighed like 350lbs and I took it over the edge of a 9ft tall dumpster by myself…..that is a whole story in itself) there are other things to watch out for, like broken glass, sharp pieces of metal and used needles.

One more (often overlooked) spot to hunt is your local dump. I’ve lived in rural areas for most of my adult life, and when you go to the dump often there is no one around who cares if you dig something out of the dumpster.

Obviously this money saving (or money making) strategy is outside the realm of socially accepted norms in some circles, but as long as you are safe about it and respect what people of authority say (store owners or dump employees) you’ll be fine.

Be flexible on living arrangements

During the first 3-4 years of our marriage we spent almost as much time living with people as living on our own. The first 9 months of my marriage I spent living in a rented room with my brother and his wife.

Next we spent 21 months in a section 8 apartment in Chicago, then we spent the next 10 months or so with a friend of my wife’s in a 2 bedroom apartment in Alaska. We haven’t lived with anyone else (except our kids) since then, but I would totally consider it if the opportunity arose.

Thrift Stores and Garage Sales

This might be self explanatory, but replacing the stores you currently shop at with garage sales and thrift stores will radically change the amounts of money you spend. I’ll confess that I’ve never been a fashionista, but I have a certain aesthetic that I find I can satisfy with regular stops at thrift stores and garage sales. Shopping isn’t my favorite activity in the world, but if I do shop, it is at thrift stores (for clothing) or garage sales (for other random things).

Only Buy what you NEED

If you want to become a financially responsible you must realize the difference between a need and a want. A need is something that you can’t do without. Food, shelter, and clothing are the ones that immediately jump to mind, but there are others. For example, if you live in the country where there is no public transportation, some form of transportation such as a car may become a need. Then you will need to carry insurance on it, pay for gas to operate it, as well as maintenance costs as they arise.

Don’t fall prey to the mistake of buying things you wouldn’t normally buy just because they are cheap. You didn’t save money there, you spent extra money.

There are three costs to every purchase: the cost to buy it, the cost to keep it, and the cost to maintain it. Having a cluttered house or garage is such a colossal waste of time. Sorting through supplies to find the one you need is expensive. Owning covered storage to put it under is expensive. Heating or cooling that area is expensive, etc etc etc.

Cool-off Periods for Big Purchases

Related to the “Wants vs Needs” concept is the idea of a cool off period. If you have something that you want to buy, but aren’t sure if it is a want or a need, or you know it is a want but you still are inclined to buy that thing, give yourself a cool off period. I’ve done cool off periods from 1 day to several months. It depends primarily on the size of the purchase. The idea is to let life go on for a while without that thing, and see how you manage. If you can manage for one month, could you manage for a year? If you can manage for a year, I guarantee you can manage for the rest of your life. Which means you should never buy it.

Don’t go to college

College is expensive. There is no way around that. I’m a huge fan of college as a way to increase your earning potential and job security, but I recognize it can be difficult to line up the free time and finances to go about pursuing a college degree. If you need help in this area, see my College On The Cheap post. Remember, college isn’t for everyone, but if you are trying to rise above your current socioeconomic status, it is one of the easiest ways.

Emergency Fund

If you don’t have an emergency fund, you are a ticking financial time bomb. Emergencies happen to everyone. Some common examples of emergencies might be:

• Job loss.

• Medical or dental emergency.

• Unexpected home repairs.

• Car troubles.

• Unplanned travel expenses. (death of a loved one etc)

The reason these can be detrimental to your financial health is that raising money to cover one of these expenses can become very expensive in itself. Short term loans, credit card debt, and other common forms of consumer debt tend to be a terrible waste of money. Once you paid off the original amount you needed to borrow, you still have to cover the expenses incurred by the lender in making that loan, aka you need to help them make a profit. If you do this, whatever benefit you received from not maintaining an emergency fund will be far outweighed by these costs. For the record, the following are not emergencies: 1. Expenses that you knew were coming. 2. Anything that involves a hobby of yours.

Roth IRA

Roth IRA’s allow you to be exposed to the upside of the stock market without tax implication. In other words, any gains you make on the money you put in a Roth IRA are not taxed. The reason I like Roth IRA’s for low income individuals is that you can use them as a form of bank account. 100% of your original contribution to a Roth IRA retirement account can be withdrawn at any time, for any reason, and without penalty. If you need to pull it out for any reason (for example to help your brother with medical bills) you can do so. I’ve contributed to a Roth IRA every year I when I was working full time and highly recommend you do the same.

Giving Back

As a Christian I personally find 10% to be a compelling minimum number to give back toward what God is doing in the world. If you ascribe to a different set of beliefs, don’t be afraid to support them. What you do with your money says a lot about who you are as a person. Don’t neglect giving unless you find that you cannot meet the basic needs as discussed under the heading “Only Buy what you NEED” above.

Budgeting

Some of you may be disappointed to hear this, but I’ve never found budgeting to be a compelling or important part of my financial journey. Maybe I’m just so cheap that things like budgets don’t help me. Maybe I’m just too lazy to budget. I don’t know, but I always have good idea of how much money is coming in due to monitoring my bank accounts, and I always know where my money is going from my credit card statements. I find that is enough to set me on the right financial path. If you disagree with me, that’s fine. Go find another blog to read… haha.

Self Discipline

My single most important piece of advice: do whatever you can to increase your self discipline. This is the one life skill that will take you further than any other in life. Don’t let money control you… control your money.

This post is getting long, so I’m going to stop it here and make another post with the same title.