Amount to Invest Today $

Amount at Retirement in Today's Dollars:

You are on the fence. You’ve thought about it, and you can’t force yourself to decide. Perhaps you’ve even developed analysis-paralysis. I can relate. I just agonized over what chewing gum to buy for the last 20 minutes. On the scale of significant to insignificant, that’d be a zero. The following are the coping mechanisms that I’ve developed to handle these situations.

Ben Franklin’s decision making strategy:

I’ve used the following decision making matrix for years. I’m not sure where I picked it up, but I recently listened to Ben Franklin’s autobiography, and discovered that he practiced this method, so the idea is far older than I am.

This works best when there are only two options to choose from, if there are more than two, then you’ll need to use another method.

First of all I try to list out the positives and negatives of the decision, either on a piece of paper with two columns or in an excel document.

Once I have a list of the positives on one side, and negatives on the other, I try to cross out items on each list in such a way that things of matching importance are crossed out together. If one item on the positive side is worth two or three from the negative side, I’ll cross out the four of them together.

The Regret Minimization Framework:

If you are inherently a risk averse individual, you may need the assistance of the Regret Minimization Framework. This framework basically asks you to project what you will be feeling at the end of your life, say at age 80, when you look back over your life. Will you regret not attempting a course of action more than you would pursuing the course of action and it being a failure? Whichever course of action causes greater regret is the route you should NOT pursue.

Giving yourself a Timeline:

You have to give yourself a deadline to make the decision. That means you set a calendar reminder for yourself, and if you haven’t already made the decision by then, you make it that day. If you don’t feel that you can do that yet, then give yourself a deadline to give yourself a deadline.

If you don’t have a timeline, it isn’t going to get done. This is true for things in the short term (because they get pushed to long term), and for projects in the long term (because they get pushed to “never”). Goals, more than anything else in life, help you focus your energy.

Choosing to not make a decision:

You will think that this is a cop-out, but sometimes passivity isn’t a bad thing. You may notice that you don’t have the capacity to spend sufficient time making an informed decision; perhaps that decision shouldn’t be made yet. This gives you freedom to tell people why you haven’t decided. You need to step back from some of your other responsibilities so that you have capacity to deal with it.

If you know that you can put it off a little longer with no repercussions, it is fine to delay the decision, sometimes clarity comes with time or new information arises that makes making the decision simpler. Sometimes you are stressing yourself out over something that will resolve itself. That being said, you probably didn’t read this article because you are having trouble putting off making the decision.

To be clear, the decision making strategies in this article are not valid in a “think on your feet” scenario; if the decision needs to be made in the next 20 minutes, these strategies may not be able to help you.

Three or More Options

Perhaps you’ve come to situation where you’ve got many options. You don’t know how to narrow the playing field to only two. I don’t have a perfect recipe here, I can just tell you what I do. I keep looking until I find some kind of information about the options that I care about, and then I eliminate all but two of the options based on that criteria.

Rational Decision Making Process:

This is most useful for larger problems that you don’t feel were adequately handled by the other suggestions on this page, and is a decision you feel needs significant effort.

1. Identify the Problem – What is the key issue?

2. Establish Decision Criteria – what is important to the decision?

3. Weight Decision Criteria – Some Criteria are more important than others!

4. Generate Alternatives – What are the options?

5. Evaluate Alternatives – This is based on the weighted decision criteria

6. Choose, or go back to step 4 and alter the alternatives.

Once you’ve chosen, be sure to write out your thinking so that when you look back over your notes from the process you can nail down why that one decision rose to the top. If steps 1-6 are too involved, then just use Bounded Rationality, which would allow you to choose the first alternative that is satisfactory and doesn’t require you to spend the additional time to attempt to find the optimal solution.

Cost-Benefit Analysis

If your decision is one that can be easily quantified in dollars and cents, then using a Cost-Benefit Analysis makes sense. I did this when I went back for my undergraduate degree. If you need this method, see my post where I discuss using the Cost-Benefit Analysis.

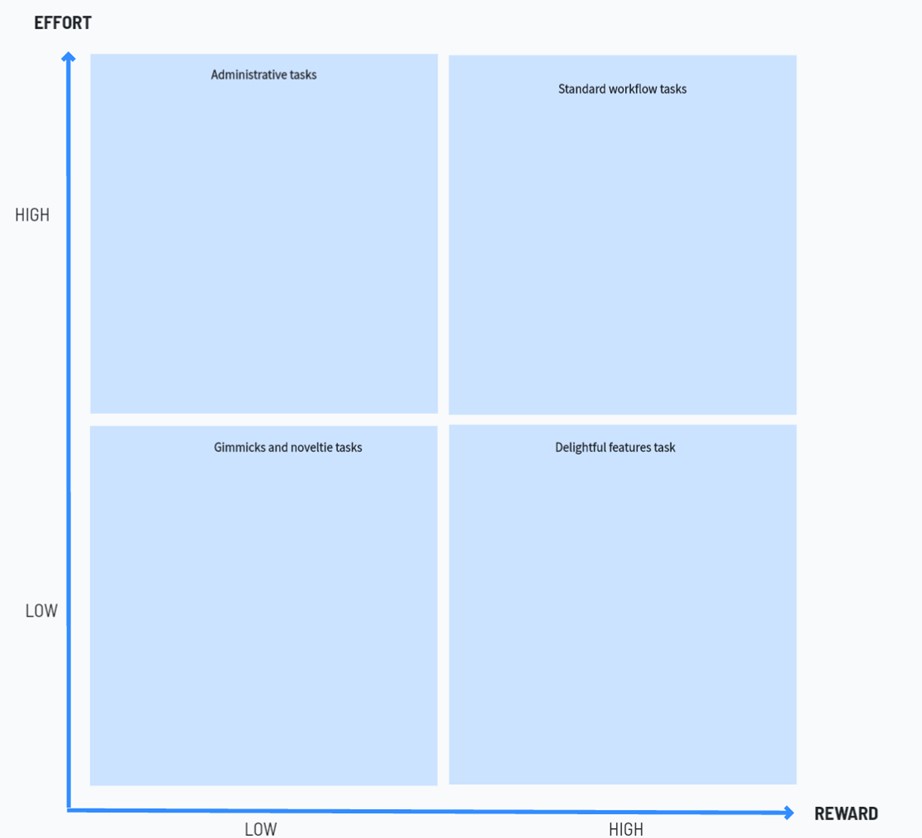

Action Priority Matrix

This matrix is useful for determining where to place your goals.

It is often helpful to compare different options by placing them in this matrix, helping you know whether the alternative is a “low hanging fruit” with high impact and low effort.

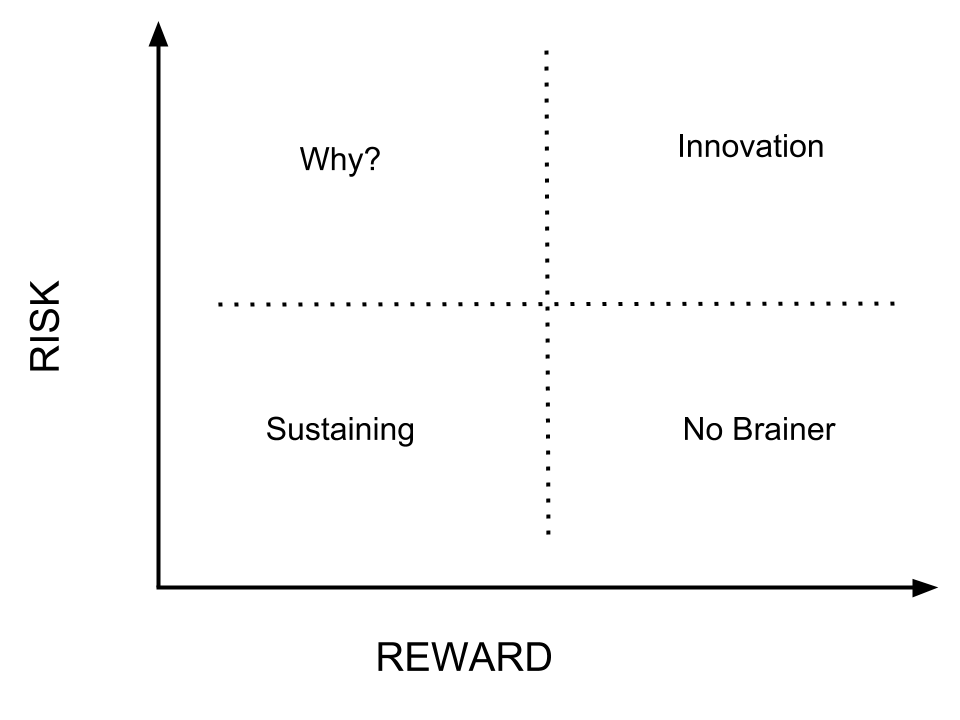

Risk vs Reward Matrix

Alright, so this one looks similar to the last matrix, but in this case, we are analyzing the risk of the project. If the decision has some level of risk, it can be useful to try to pinpoint where on the following diagram the activity lands.

Using Chance

In cases where you truly can’t make up your mind, and there doesn’t seem to be an obvious leading choice to make. I use chance. For years I believed that chance had no place in decision making. It never seemed to work for me. Even after I flipped a coin to decide, I wouldn’t be able to force myself to follow that course of action. What I realized is that flipping the coin is a test to see if you really care about something. If I flip a coin and I truly don’t care, then I will easily be able to go with the outcome dictated by the coin. If I care, and flip the coin and don’t want to do what the coin says, then I do the opposite. This only works in cases where there is no clear choice.

So you’ve decided you want to move, but don’t know where you should apply for jobs; or maybe you are ready to settle into that early retirement you’ve always dreamed of. Hear me loud and clear: where you live does matter! I have read multiple academic papers that claim that where you live generally doesn’t have a significant effect your happiness. But I don’t buy it. For one thing, self reported “happiness” is a very suspicious metric. How can I tell how happy I am if I don’t know how happy I would have been somewhere else? I believe now, and always have, that we need change in order to be happy. But that’s a topic for another day.

These are the metrics that I analyzed when considering where to live:

If you want to escape your family, increase the distance between yourself, if you want to stay close to your family, don’t underestimate:

If you are fortunate enough to have family support (especially if you have or are going to have children) don’t underestimate how nice it is to be near family. Many grandparents love to watch their grandkids. Even if they don’t, I can’t tell you how useful it is to have someone who’s stuff you can borrow. My dad owns a skid-steer and a flatbed trailer, and if I lived a little nearer, I could borrow it anytime.

So maybe weather doesn’t matter to you. But some people insist on having snowy winters. Some people insist that they love HOT days. I’m of the opinion that the more days that I can be outside enjoying the outdoors, the better. So weather with highs in the upper 60s to the mid 80s are ideal for me.

There are other things to consider: for example, if you like to garden, how much precipitation there is, and how long the growing season are become important.

If you Love fall colors, then you need someplace with a cold enough climate, as well as deciduous forest.

For the love of Pete, do not settle in Northern Minnesota or North Dakota. Winters there are brutal.

Depending on how far north you are, the days can get very short in the winter, which makes going outside that much harder. For example, the length of a day in December in Anchorage, Alaska, is less than 6 hours. So if you work during those hours, you may not see the sun except during the weekends.

Here are some websites I’ve found useful when looking at weather:

https://outflux.net/weather/noaa/index.php

https://www.weatherbase.com/compare.php3

https://www.usclimatedata.com/

Yes, it matters how much you can make. But it also matters what the cost of living will be for you in that area. The older you are, and the less likely you are to settle for an apartment with multiple roommates, the more likely this is to to make a difference. When I entered the location search scene this time, it was with a wife and 4 kids. So the expense of real estate became an important consideration.

This website will allow you to search by job title and area, and see what the median wage is:

https://data.bls.gov/oes/#/occGeo/One%20occupation%20for%20multiple%20geographical%20areas

This website will allow you to compare the cost of living in multiple cities:

Remember that it doesn’t matter how much you make, what matters is how much of what you make you can save.

If I were to move to silicon valley, the area with the highest wages for my career, I wouldn’t be able to purchase a home, and my rent would be over $50,000 a year, which makes it pretty difficult to save, even at wages coming in over 85k (gross) for entry level positions.

Another important consideration is that of taxes, this website allows you to compare different area’s tax rates:

https://smartasset.com/taxes/income-taxes

Early career go-getters will suffer if forced to work in an environment that does not reward their energy and enthusiasm. Larger metropolitan areas tend to have a greater selection of positions, leading to a easier and shorter job search for the kind of position that you want.

We each have our own preference, which I believe can change, but if the area doesn’t have at least one of the following, you might want to consider why you chose that location over another similar location: Clean Cities/Mountains nearby/Water view/Beach/Low Crime

Proximity & Quality of Outdoor recreation:

For those of you have kids, a spot for the kids to safely roam outdoors might be an important consideration, as well as good schools.

You need to consider what is important to you. The following were deal-breakers for many US cities that I considered:

There may be some intangibles that just can’t be qualified. Maybe you don’t want to be associated with Idaho because Idaho is only known for it’s potatoes. Or maybe you don’t want to be in a place with lots of hippies. Maybe you have connections to an area due to childhood stories or visits. Maybe you have a friend that moved to an area, and you’d love to live close to them. Wherever you go, make sure you make an informed decision, as moving is a lot of work, and you don’t want to discover that you don’t like the place you’ve moved to after just a few months.

The investing strategy that I follow is a “get rich slowly” scheme. I’m not into chasing down returns. I don’t need high risk/high reward for the majority of my investments. If you don’t want to spend your life consumed by what the stock market is doing, keep reading. If you feel like that is something you need, I recommend pulling out 5% of your portfolio and doing day trading or cryptos or whatever you need to do to get that out of your system, because emotion based investing is the enemy of your portfolio. I understand that for some people there is relational component; that picking stocks or sharing in current trends may allow you to participate in conversations with your friends. I don’t discount that, but if you want the best returns on average, with significantly lower risk overall, don’t do that with your main portfolio.

I could have titled this post “Investing Strategies for Boring People”, but you probably wouldn’t have clicked on that one would you? If you like high risk activities, and want your money to make a huge gains, find another website. What I’m espousing here will change your life, and leave you with a near 100% certainty of adequate nest egg upon retirement, but it won’t double your initial investment in 6 months. That kind of growth is unsustainable, and certain to reverse at some point. The risk is commensurate with the reward.

Some people hear the term “Passive Investment” and think bad returns. That is simply not the case. I like investing in the entire stock market. The real return of the market is 8.8 percent since 1887 (that is without the negative annual return of 2% from inflation, so actual rate would be 6.8%). That is a rate of return that would allow you to retire comfortably on just 6k per year investment throughout your working life.

Passive investment should be part of your investment strategy, if you get the itch to actively invest (I accept that people like to gambling with their money for fun) it is highly expedient for your long term wealth building that you only do so with a small part of your portfolio. The risk from this method is that you may not even get the baseline of the total stock market’s annual increase, additionally, you are likely exposing yourself to several times the amount of risk, so your risk adjusted return was even lower! Risk is one of the most underestimated factors in any investment strategy. When you invest in a high risk sector, you basically become your own insurance. If a catastrophic event occurs, you are the one who pays out, if no catastrophic event occurs, you make money, and good money at that! Ever read the “Black Swan” by Nassim Taleb? There are always unforeseen catastrophic negative events that will occur. So beware.

I’ve noticed that whenever stocks are going up more rapidly then normal, the stock market tends to a get a lot of additional press attention, and this often draws inexperienced investors into the market at the worst possible time to enter the market. When the market corrects there is a lot of negative press, and inexperienced investors may be influenced by these reports to get out of the market. Fight that urge.

This is what happens when you try to beat the market average. People trying to beat the market find themselves on the losing side just as often as the winning side, but they pay a higher price. The fees of an actively managed account often eat up the profit that the account claims to deliver. In addition to this, the tax implications from all the trades necessary in an actively managed account make it a particularly poor choice for non-tax advantaged accounts. It is estimated that the global financial services market is 26.5 Trillion dollars. That’s Trillion with a T. 20-25% of the world economy. Someone is making money off of every dollar you save, invest, transfer, or send. It is in their best interest to convince you to pursue an actively managed account.

One of the largest indicators for the success of a fund is the expense ratio, it is pretty much the only thing that you know ahead of time when you buy into a fund. In the field of investing, it is a generally accepted maxim that “past performance is no guarantee of future results”.

Time to get practical:

The best place that you can dump your money if you want a “set it and forget it” approach to investing is a target retirement date fund from Vanguard such as VFFVX.

I’m a huge fan of Vanguard. They are non-profit, which allows them to have low fees on most/all of their mutual fund offerings, the funds I’ve used are:

Fidelity has some zero fee funds covering the U.S. and international stock markets. The funds are: FZROX and FZILX, and if I was just starting out and around 20-25, I’d consider dumping half in each.

Please take the time to read the common topics section from Reddit’s “Personal Finance” website. That resource will give you a great overview of investing and personal finance. The graphical flowchart is an especially great resource.

I do not recommend investing if your timeline is less than 5 years (as would be the case if you were planning to pay off student debt with the money/put a down payment on a house/buy a car). In that case you’d want to consider a high interest Savings account or similar.

This will require you thinking ahead. It takes some serious planning in order to figure out what your future holds and what you will want to do with the money. Don’t hear me wrong, I think you should invest a percentage of every single paycheck that you earn over your career, but don’t plan to take any of that invested money out to finance a particular purchase in the near future.

There are other ways to invest intelligently besides the stock market. The ones that come to mind are Real Estate, Business Debt, and personal improvement(usually education). Please see my other articles on these subjects.

Don’t chase past earnings in mutual funds, and don’t pick stocks. You will not win in the long term. Everyone likes to remember (or brag about) that one pick from years ago that turned into an Amazon, but think of how many companies didn’t make it through the dot-com crash. Thousands… are you going to pick the stock that goes to the top? Unlikely. If there is any doubt about this point, I can forward you some literature so that you can convince yourself it is a bad idea to play with this. It is also a royal time-suck. Devote your time to getting better at your job or developing a sidehustle, not this.

One last site: firecalc.com

If firecalc doesn’t change your life, nothing will. It takes a minute to figure out how to use it, but it is fun to see what your investment will grow into if you let it.

https://www.citi.com/credit-cards/credit-card-details/citi.action?ID=citi-secured-credit-card

For those who are just starting their financial journey with no credit history, I recommend a secured card because most likely you will be turned down for anything else. Having a credit score is important because it allows you to use credit cards with rewards. (My credit card (Citi Double Cash) gives me 2% back on all purchases). It is also important if you decide to purchase a house anytime in the next 10 years or so. If you get turned down by one bank for a secured card, apply for another, and keep applying until someone is willing to take a chance on you. I walked into a US Bank at the age of 19, and was turned down by their system, but the banker called me a couple days later and said he was willing to take a chance on me. They made the right choice, as I’ve continuously maintained an account with them since then, and have yet to make a single late payment.

I recommend storing any savings that you will not be using in the next 4 months in this bank account: https://www.ally.com/?context=bank This bank gives you one of the higher % interest return per year for using them, as compared to 0.1% as an average for all banks in the US. This is important because it gives you a decent return with no effort on your part. It is dead simple to transfer money to and from your local bank’s checking account (or credit union) directly from this account. It literally takes 3 button clicks once you log in to transfer money either direction (And takes 1 business day).

For a retirement investment account, I recommend Vanguard: https://investor.vanguard.com/ira/iras

Create a Roth IRA and contribute up to $6000 (Your spouse or significant other can also contribute this much). This is taxed money, but it is not taxed when you pull it out at retirement, and you can also pull out what you put in at any time and with no penalties or fees. The fund that you will buy is a “Target Retirement Date fund” for year ~when you will retire. This manages your funds for you so you never have to think about it. If you want to invest more than this, or in other things, you can, but I’d recommend this at a minimum every year you are working.

“Investors should remember that excitement and expenses are their enemies. And if they insist on trying to time their participation in equities, they should try to be fearful when others are greedy and greedy only when others are fearful.” — Warren Buffett

There is money to be made on the meteoric rise of cryptocurrencies, just watch out that you don’t lose it all on the way back down. Like every bubble, there will be winners and there will be losers.

Like any investment strategy, the potential reward for investment must balance out the risk. At this stage, Cryptocurrencies are both risky and (potentially) very rewarding. Anytime there is “easy money” to be made, there is going to be an eventual collapse, because when the people that flocked to an investment due to a sharp increase in price experience their first dramatic decrease in price, they won’t enjoy it, and will pull out of the market, or switch to another investing medium. “But,” you exclaim “retail investors only account for 20% of the market!”. That is indeed true, but there are two things you need to remember:

You probably wouldn’t have guessed it, but I’m actually very bullish on the role that cryptocurrencies will play in the future of mankind. What I’m not bullish about is any particular cryptocurrency. Do you remember the dot-com bust? Remember pets.com? No? It lasted 9 months after it’s IPO. I’m not saying that cryptocurrencies are stocks, they aren’t. What I’m saying is that survival of the fittest dictates that many die out before we find who will provide long term value to users, and eventually long term gain to investors.

I entered the cryptocurrency world with money that would have otherwise been left sitting in a bank account in late 2017. I didn’t bet big, because I was a poor college student. But I did it right, I had a well diversified portfolio of over 40 “alt-coins”. I realized at some point that the current market trajectory was unsustainable, (January 15th of 2018) and took my money out. For those who are wondering what happened in the market, the following 3 months were an absolute blood bath, it tanked, and tanked hard. I only took out what I had put in. I liked to pretend that the rest was “monopoly money” but in reality I still wanted to bet on the crypto currency market. In all I’ve roughly quintupled my initial investment. Am I happy about that? I guess I am, but I can’t help thinking that it was mostly luck. I had no idea what direction the market was going to go, and I had no idea when I needed to pull out of the market, I had no idea that if I left my money in there that the market would eventually come roaring back. I have a lot of friends that jumped in during that time, lost a bunch of money, sold out, and never got any of it back.

I learned a few different things about cryptocurrencies:

To date, I’ve although I’ve had many enthusiastic conversations about the technology behind cryptocurrencies, I have not yet counseled someone to buy, and I always tell people to sell. Don’t get me wrong, I’m bullish on the crypto-market in the long term, but I’m not bullish on the average individual being able to pick the winning cryptocurrency. So if you feel some urge to gamble 5% of your investment portfolio on something with serious upside….sure, go for the broad crypto market. Otherwise, stay far away.

For those who are interested in some further reading, allow me to point you to the following link… I’ll warn you that although there are plenty of coherent thoughts in this article on the crypto space, I don’t agree with him that there are zero potential use cases for Crypto, simply that the exuberance seen right now in the crypto market is severely misplaced and is in essence a massive bubble. I especially appreciate what he has to say about NFTs. https://www.currentaffairs.org/2022/05/why-this-computer-scientist-says-all-cryptocurrency-should-die-in-a-fire/

I’ve been where you are. In fact, I didn’t know what I wanted to do with my life until I hit 25.

I’ve lived in the Eastern, Central, Pacific, Mountain, and Alaska time zones since leaving home. See my post on choosing a geographical location. I’ve also worked in 4 wildly disparate career categories. So I feel like I have a pretty decent grasp of what the United States has to offer for a young person like yourself.

Picking a career can be hard. Even deciding if you want to go to college can be difficult, let alone what to study or which school to pick. Read on for a few of the pointers that helped me in my own personal search for the perfect career:

If you are fascinated by a subject, and you want to/are willing to study it in your free time, you might want to pursue a career in that thing, whatever it is. Think about what you spend time doing, and what you would like to spend more time doing if you could.

If you have a talent that you’ve practiced hard to get good at, and you are the best person you (personally) know at that thing, you should probably consider how you can fit your ability in that area with your calling/vocation in life. It might not fit with any of the careers that you are aware of, but ask people that you respect if they know of ways to apply those skills in a career path.

This is your raw potential. What you are capable of at your very best. You haven’t developed a skill yet but you know that you could. This is your maximum potential under the right circumstances. For example, not everyone can succeed at math. You may be one of those people. If that is the case, engineering is not for you, no matter how interested you are in it. Engineering Technology on the other hand, perhaps. Even if you are great at math, perhaps you lack people skills. You didn’t get the opportunity to develop them in the environment that you grew up in, but you are confident that they will come. Start to try things out to see if you can master them, the more things you try out, the more you know what you have the ability to succeed at.

Certain careers take significantly more self discipline. If this isn’t something you’ve cultivated yet, consider whether you think you’ll be able to, or whether you’ll need to downgrade your aspirations to fit your lack of self discipline. (Keep in mind that you can increase your self discipline, this happens for many people as they age. For example, I personally wouldn’t have been able to finish an engineering degree had I started it directly out of high school, or if I had, my grades would have been far far worse.

Not everyone is in the position to move forward with a college degree because of their finances. Very few people can live for free (though school can be almost free if you are smart, see my post on going to college for $75 a week). If you haven’t developed the necessary nest egg for school, consider living cheaply and working your tail end off until you have what you need. Be careful though, many people lose sight of their dreams and settle into a life of tedium because they don’t see progress toward their goals here.

Going to school is a difficult undertaking for more than the person who chooses it. It can be hard for their family and friends as well. I chose to go back to school later in life. I was able to choose that because my wife was supportive and did what it took to keep me in school. If you are a single dad, or you are providing for an elderly parent, excelling at school is going to be a lot more difficult, and you may need to take easier classes, or less classes per semester to maintain your sanity throughout school.

The biggest thing I can emphasize when considering your career path is to think ahead. Right now your interest is theater? Great, but be aware that you will probably not be among the stars of the stage. The chances of you landing a solid acting career are slim, and even slimmer if you aren’t willing to slog through several years of rejections before you get there. The data is in, and it shows that only about 2% of actors make enough money to live on. For every Morgan Freeman there is, there are literally thousands of extras who never get beyond the occasional un-credited acting part. Temper your dreams with reality. Get input from people you respect (real input, not just asking them to encourage you in the direction you’ve already chosen to go). If you like Computer Science and Pottery equally well, choose pottery as a hobby and the other as a career.

Be aware that your preferences change over time, so even if you don’t mind being a starving artist now, there may come a time when it gets irksome.

Start to try things out to see if you have interest in them, the more things you try out, the more you know what you find interesting.

Kids are expensive. If you plan to have children, consider choosing a higher paying career, even if your job satisfaction is slightly lower.

Not everyone who tries to become a full time artist will succeed. I can’t tell you how many people I’ve run into over time that have an “soft” degree of some kind who went back for a second degree, or leveraged their experience to move into another more lucrative but less desirable field. So when you are thinking of what career to pursue, be aware that those with extremely high job satisfaction often have a higher attrition rate because more people want those jobs than there are jobs available.

Please don’t be like me. A significant portion of my thought process for where I went to college directly after high school was something like this: “I want to go someplace that sounds fun”. My brothers had gone to a small college in southern Wisconsin that sounded like something from a dream. Cool people to hang out with, inter-mural sports 6 nights a week, and a cush job nearby that made paying for it all easy (notice that even 18 year old me thought about the financial side of things). They said the academics weren’t too challenging, which was a huge plus for me. I loved hanging out with people, and the way my brothers described it, there was a lot of that happening there. That was it. I asked my brothers whether I would be able to pay for it based on what I had in my bank account, and they said that I’d be fine if I could get the job that they had done: driving school bus. That was my entire economic analysis of where to go to school. No other opportunities were seriously considered. No idea what I would do with the degree when I graduated. And no awareness that technical schools existed where I could go to school for free… More on that in my other post here.

Cross cultural experiences:

Peace Corps: This is honestly a giant boost for your resume. I don’t exactly know why this is, and it isn’t something that people advertise, but everyone I’ve ever talked to in hiring has immense respect for someone who devoted a year of their life to a greater cause.

Christian Mission Work: If your church supports anyone, contact them and see if they need any help, or know of someone who does. This would be for those who would like to combine their volunteer service with something that they value, their relationship with Jesus.

Experiences in the USA:

Bible School: This is the route I personally did after High school. A solid choice if you feel uncertain about what you believe and you’d like to gain clarity about the Bible.

Wilderness Mentoring Camps: I have several friends that either run these or have attended them. They seem to be a mixed lot, with some being good, and others being a miserable experience. You should definitely talk to someone that has graduated from the program before you embark on this one yourself.

Start Your Own business: You can literally start your own pressure washing or lawn care business for a couple thousand dollars. See here for some other business ideas.

Work in a Factory: This is not something you want to do long term. Don’t get me wrong, there are certain perks, but it certainly isn’t the type of career that anyone should pursue unless life circumstances have closed all other doors. The remuneration is terrible.

Work in the trades: I worked in the trades for about 3 years full time, and an additional 2 years part time. I loved it. But the chances of sustaining a life altering injury are very high in this career. Accidents happen. The pay is fine, and most of these career paths allow you to open your own business (if you have the desire) after you have about 10 years of experience. But be prepared to “pay your dues” no one is pleasant to you in this type of position until you have proven yourself. And even then, many of the individuals you work with are, how do I say this delicately, “rough” / “real pieces of work”. Also, many of the jobs that you work (especially early in your career) may not cover vacation days.

Other: There are a few of you, probably less than 1 in a 1000, who have the chutzpah to do your own thing. Start your own business, succeed on your own, get excellent at that skill, and make money doing it. Go for it. Do it. Don’t be afraid of failure. Be afraid of not trying. The best time to fail in life is when you are young. That is because you have so many opportunities to recover after your failure. Also, when you are young you don’t have a lot of the baggage that you acquire later in life. You only have a finite amount of time, and if some of it is being eaten up in a relationship with a spouse, with kids, with maintaining a home, etc, you won’t have the time to focus on making that thing succeed. Also, unless you wait until later in life, when you’ve already amassed a decent amount of money, it can be very difficult to pursue something as risky as going out on your own or starting your own business when you have a family to support.

The following website will change your life if you let it:

It gives the wages of all the different jobs, and also has a write up about the amount of schooling that each career takes. I HIGHLY recommend it during your career search process. There is also a section on that website about what each career is like. You should read every article you can on the subject of your interest.

Please also consider reading my article on whether college is a good choice for you or not. For those of you who’ve already decided to go to college, how should you decide where to go to school? There isn’t any way around it, it takes work. Sit down and make a list of every school that you’d be willing to attend. Get on their website and look up their yearly tuition price, add $1500 to that number for fees and books. Multiply that price times the number of years you will be at the school, and that is the cost of attendance. Make an excel spreadsheet that has each of these numbers next to the school name, and list any other factors that would bring the cost of attendance up or down (expensive rent/living with parents/etc). A website like US News can make this process a lot quicker. I’d highly recommend using that site or a similar one, even if you have to spend a few bucks for a subscription.

Okay. Here it is. If you walk away from this post with anything, make it this. Everyone has different interests and talents, but most people are not exceptional at anything. That isn’t a bad thing. I’m not exceptional either. That means that I probably am not going to make a good living as an artist, surfer, or some other job where the job satisfaction is VERY high, but median pay is low. This is why I went school for engineering. It was the shortest degree program I could find where the median wage over your career was north of 6 figures. Even a mediocre engineer makes good money.

You have the ability to DO HARD THINGS! I can’t stress this enough. YOU CAN DO HARD THINGS! School will be hard. Especially if you chose a career that has high expected earnings once you are done. People don’t know what they are capable of until they choose to try.

Don’t be afraid of taking a leap and failing. You found out something that you couldn’t do (at least at this point in your life). Find something else. And don’t be afraid to come back and try again, but give yourself some time to mature and gain some skills before you try again.

I believe in you. Get after it.

Listen, if you want to slip the colleges an extra $10,000 a year for your college experience, I’m fine with that. I’ve come to peace with the fact that not everyone can do what I did. But a quality education is still available to people at an affordable price if they know where to look. Anyone can graduate from college debt free if they want to. And that means you… yes, you! If you want the story version with all the juicy details, keep reading. If you just want the strategy I used, skip to the section with the headings.

Here is how I went about getting not one, but two undergraduate degrees for what many people spend on their first year (or even first semester!) of undergrad, and how you can do the same. Some of these tricks I used from the very beginning, and some I learned several years in.

There are 5 schools in my college experience, I’ll start with the most recent first:

I attended a state school in Alaska. The average cost of attendance was $4400 a semester, which is far below average, even for a state school. On average I paid less than $2200 a semester. The difference was made up by scholarships. My overall cost could have been far less, but I didn’t decide to attend school my first year until after the deadline for scholarships had passed. In other words, 56% of what I spent at the University of Alaska was during my first 12 months there. Total cost for 4 years of full time school? $17,600

I averaged $1000 dollars a semester for 3/4 of this undergraduate degree. How? Part of it is luck; I received in-state tuition at one of the cheapest state schools in the USA. The other part of it was hard work. I spent time on local scholarships, and they drastically reduced my overall school cost. In fact, I treated scholarship applications as a type of part time work. During the time when most scholarships had their deadline, I worked non-stop on them. Probably averaging 5 hours per scholarship application. At this point I already had a bachelor’s degree in education and this worked to my advantage as I filled out scholarships. I spent far less time than some people on scholarships, and I turned out high quality (judging by my success rate) applications.

I went to two different schools where the tuition was free. Yes, free. They were Christian schools and their goal, aside from education, was to prevent their students from graduating with debt. That didn’t stop one of them from charging ~$1000 a semester in fees, but who am I to complain? This is probably of limited usefulness to most you, since not everyone wants to go to a Moody Bible Institute. But it was great for me, and I walked away at the end of 4 years with an accredited undergraduate degree in education (Counseling to be precise).

After starting at this school, I learned about another school that would accept my credits toward an accredited bachelor’s degree. That sounded like a miracle to me, since I had no idea that accrediting agencies existed just a few months earlier, and hadn’t thought to check my school before I began. So began my process of transferring credits from one school to another. I’ve now attended 5 different schools. I promise that I hated school when I left highschool. There was nothing that sounded more boring. Learning grows on you though.

The strategies that I employed:

If you haven’t applied for this, you are throwing away money. Every single person who goes to school needs to apply for the Fasfa. Try to apply about 9 months before your classes start. At one school I went to I received a “Pell grant” for 110% of my tuition costs. This covered my tuition and all of my books, and I had some spending money left over. I can’t emphasize how important this is, especially if your parents are low income (student aid awards consider the income of your parents, as well as your own, until you turn 24, when it becomes dependent on your income alone).

This is the website where you’ll need to go to fill out the forms:

https://studentaid.gov/h/apply-for-aid

If you can, find some people that you respect to rent with. This could go really well, or it could be really hard. Even under the best circumstances, I’ve never lived with a group of people without having some high stress moments, but it has always been worth it. You will get to know people very well when you live with them, so make sure they are worth your time before you move in with them. I lived on campus, or off campus in a house with others up until I moved in with my wife.

I highly recommend part time work to most people, unless they are shooting for a 4.0 GPA or have some other good reason to not work. I highly recommend looking for a part time job during your freshman and sophomore years in school that will allow you to work on homework while on the clock. Once you are a junior or senior, you hopefully be able to find a position that will build skills for your career. During each of my 4 year degrees, I graduated with more money in the bank than I started with. In order to do this, I worked full time in the summers doing what I knew how to do, construction. Use whatever skillset you have to make money. If you have no skills you can always be a waiter, busboy, coffee shop barista, valet, janitor or window washer.

Some people seem to have an allergic reaction to loans. They break out in hives at just the mention of that dreaded word. Maybe you are this type of person, you wake up clutching the sheets and shouting “24% APR COMPOUNDED DAILY, NOOOOOO!! Please read this paragraph with great care, because I’m going to tell you a secret that can change your life. Debt is only bad when it decreases your overall financial well-being. To illustrate this, take home ownership. Historically speaking, home ownership can be a great investment. If real estate prices rise at a greater pace on average then the current going interest on a mortgage, you may make money by being in debt! I bring this example up first, because the debt averse person is usually willing to make an exception for a house, simply because most people can’t afford a house without taking on debt. College “CAN” be far more advantageous then any mortgage, even with deep debt. Consider this: with 4 years of school, I literally doubled my earning potential. I have pay stubs to prove it. Even if I had to go into debt to do school (which I didn’t), it would have been a brilliant strategy. Say for the sake of argument that I needed to take out loans to finish that degree. The average student loan at graduation is $25,921. That means I could have paid my loan back in the first year after graduation, and still had an extra $10,000 to spare, not to mention a lifetime of increased earning above that. Do you understand why I think some loans are an acceptable risk? The risk is actually quite low for academically competent individuals who carefully research their desired career path and understand how the specific degree program and school that they’ve chosen will affect their work life & post graduation finances. If that isn’t you, then you need to do the research. If you are the type of person who isn’t capable of doing that sort of research, then maybe college isn’t for you.

I have an overactive conscience that won’t allow me to use any digital content that I don’t personally own, which eliminated the common strategy of finding textbooks online. What I did do was buy a previous version of the textbook, and often literally paid $200 less than my classmates for the book. Then I’d borrow someone’s book and copy down the questions that the professor required for that week, using my own book for everything else. I’d estimate this can save you from $150 to $800 per year on the cost of books. Libraries sometimes carry class textbooks, but you’ll have to email the professor early in order to find out what book the class uses, and check it out early from the library to be sure you get a copy (there are other cheap people out there too).

If you don’t have to have a car, don’t have a car. Insurance, gas, and maintenance can really add up, especially if you can’t do maintenance yourself.

Incidentally, I have never taken the SAT or the ACT. I started my college career at a non-accredited school which didn’t require any standardized test before entrance, and after that I was always a transfer student. But I have done my fair share of other standardized testing. Mostly college placement exams and CLEP tests. I did 17 CLEP credits. If I had been able to do more for my degree programs, I would have. They were so much easier then taking a class. The average time that I studied for my CLEP tests was about 8-10 hours. Less than many final projects, even for easy classes. I never failed a CLEP test, so I probably could have studied less. The one exception to this was Chemistry. I studied Chemistry for hours and hours. I never took Chemistry in highschool, so it was some kind of miracle that I was able to pass a CLEP test that covered two semesters of college level chemistry and lab. I highly recommend CLEP testing as an advantageous way to knock out some credits for (virtually) free. I think the tests were $80 each, including the proctoring fee. College credits are on average about $500, which means you could be saving thousands of dollars by taking CLEP tests. If you have interest in getting a college degree using CLEP tests or similar strategies check out www.degreeforum.net.

I already mentioned it above, but spend time on scholarships. I don’t know how to emphasize this any more strongly. There are scholarships for people with good grades, but there are sometimes even ones specifically for people with bad grades. I recommend spending the most time on regional or local scholarships, then state scholarships, then national scholarships, as I never received funding from any national scholarships, but plenty of help from the others. Call the school you are attending, speak to their financial aid, and ask about scholarships that you can sign up for. They will steer you in the right direction. It is even worth setting up an appointment with someone who would know about scholarships if possible. Do this long in advance of the start of the school semester. My school had a cutoff in February for most scholarship applications for the following fall.

I highly recommend looking up every professor that you take using this website:

http://www.ratemyprofessors.com/

It gives you some idea of how difficult the professor will be. This allows you to plan much better for what classes to take in any given semester before the semester starts. This is only useful if other people have put a fair amount of reviews up. If you have a friend who is a year or two ahead of you in the program they will likely have a much better idea of what courses & professors will be difficult or easy.

These are public colleges that focus on non-four year degrees. They are cheaper, and usually require lighter homework requirements per credit hour. I knew people who couldn’t pass the physics or chemistry classes at the 4 year college, and they reported significantly easier classes at the tech school. They can also be a good strategy if you want to go to college, but haven’t decided on a major yet.

I’ll just include a link so you can look it up yourself, but America subsidizes virtually every American college student with this tax credit.

https://www.irs.gov/credits-deductions/individuals/aotc

Transferring credits is hard. It is so time consuming to try to figure out what credits will apply where. You will likely spend HOURS trying to understand how your credits transfer from one school to another.Take the time. It is worth it. I remember spending literally days figuring out what credits would transfer to my next program in school.

Honestly the credit transfer system for schools is broken. At some point you will need to see an academic advisor to see if your credits will transfer in. Very few schools will analyze your transfer credits unless you are an admitted student. If you are transferring credits, apply to the school and see what they say. If you don’t get the transfer credits you need, you are might lose out on your application fee, but that is better than having to retake entire classes because the school wouldn’t accept your transfer credit.

Once I started school, each progressive school accepted transfer credits from the school before it. It is a bit of a hassle to transfer as they usually require you to provide all kinds of information about the course work from your prior school, but think about how much time (and money) you’ll save by not having to complete any additional coursework! Transferring credits is a great strategy and you shouldn’t be scared to do it!