This analysis is most useful if your decision lends itself to quantification in dollars and cents. I did a cost benefit analysis during my first year in the engineering program to compare a career as an electrician to that of an Electrical Engineer. The time to payoff was longer than I had expected, about 12 years overall, but obviously 4 of those years I was earning reduced wages, and also paying for school.

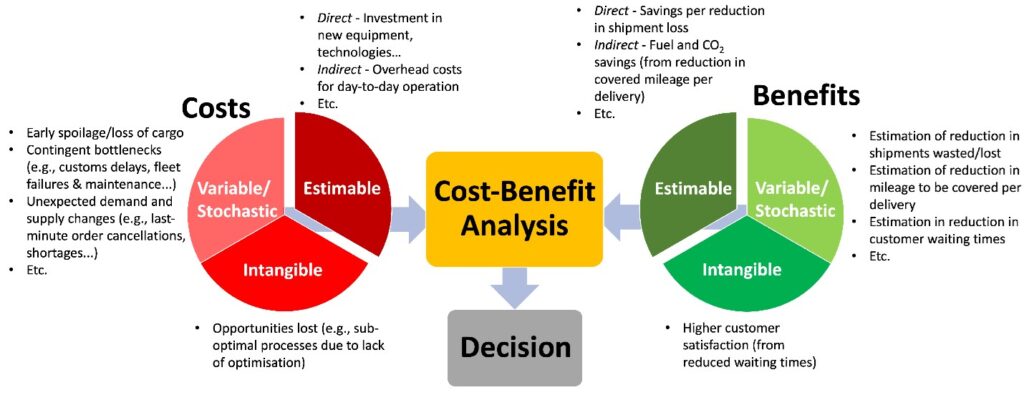

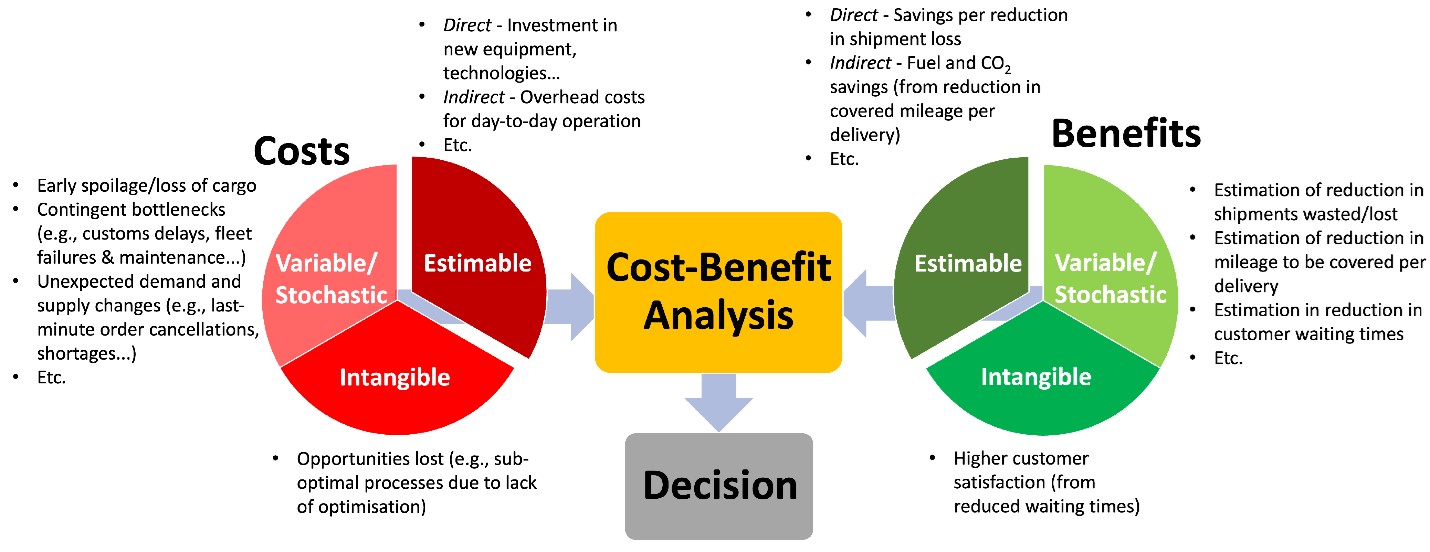

I want to help you understand the diagram above, so let me give some definitions. If the chart already makes sense to you, skip the definitions.

Variable/stochastic: Definition of “stochastic”: randomly determined; having a random probability distribution or pattern that may be analyzed statistically but may not be predicted precisely.

Estimable: Capable of being estimated.

Intangible: Something that can’t be nailed down.

Why would I do a Cost-Benefit Analysis?

- Determine the soundness of a decision.

- Provide a basis for comparing alternative decisions.

What does the process look like? Where do I start?:

- Brainstorm costs/benefits.

- Assign a weight or dollar value to each cost and benefit.

- Compare the overall costs to the overall benefits, (assess the alternatives)

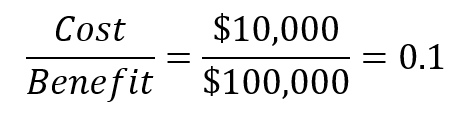

Cost-Benefit ratio: cost divided by benefit. The closer the ratio is to zero, the more likely you should implement that course of action.

Be careful when you are doing analysis of this type. You need to take into account the time value of money. The value of $1 now is not the same as the value of $1 when you are 60 years old. Both because you could invest that $1 in the interim between now and when you are 55, and because earning $1 will likely be significantly easier when you are 55 then it is now.

Comments

One response to “Cost Benefit Analysis”

[…] If your decision is one that can be easily quantified in dollars and cents, then using a Cost-Benefit Analysis makes sense. I did this when I went back for my undergraduate degree. If you need this method, see my post where I discuss using the Cost-Benefit Analysis. […]